Consider this before you decide whether to buy directly from the creator or on the secondary market

Generative art and primary markets

Generative art and NFT collections with ‘generative traits’ have been all the rage in 2021. These collections consist of a few thousand NFTs, all so similar that they’re clearly part of the same collection, but just different enough to all be distinguishable from each other. Certain traits such as the color of an avatar’s skin or eyes, or its shirt or hat, make each NFT unique.

Four samples from two of the popular generative NFT collections: Robotos and Skvllpvnkz Hideout

These traits are automatically generated when a new collection is first launched and each NFT is purchased, aka minted. If you haven’t yet tried minting, here’s the key thing to be aware of: You won’t know the looks of your NFT until after you’ve purchased it. It will reveal itself right away, or after some hours depending on the project.

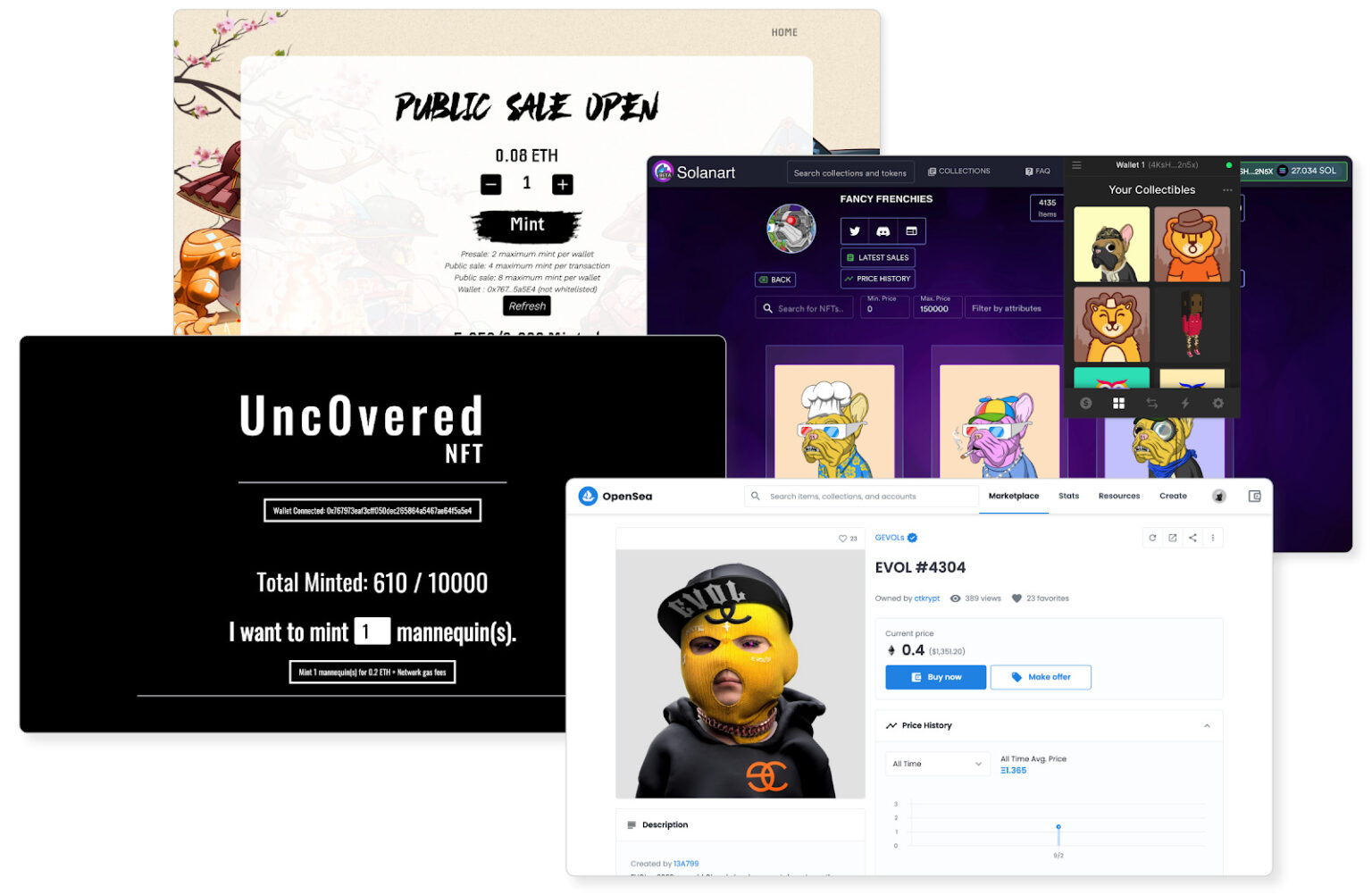

Sales between creator and collector, aka the primary NFT market, is usually conducted directly on the creator’s own website. Afterward, collectors can trade amongst each other on secondary marketplaces like OpenSea and Solanart.

Live minting on two NFT projects’ websites: Unc0vered and Shogun Samurais

The process is typically a little different for 1-of-1 artwork or editions, so I’ll focus on the generative trait collections in this article. These are also the ones where you have the most things to consider before deciding whether to buy from the primary or the secondary market, both for each individual NFT project and perhaps as your general preference for future purchases.

Benefits of minting

Low cost of entry

Perhaps the primary benefit of buying an NFT when it first launches is the price. Assuming we’ve done our research and concluded that it’s a project worth betting on for the long term, the mint price should be the lowest you’ll ever be able to buy it at.

Creature World is just one example of a collection that after launch never traded as low as its mint price (ref: OpenSea)

Because of market dynamics and short-term speculators, there’s no guarantee that the price won’t dip below our entry point right after launch, but the price should only trend upwards from the initial launch.

Save on transaction fees

Continuing the point above, minting also has the added benefit of allowing you to buy multiple NFTs in the same transaction, thus reducing your transaction cost per NFT.

This is really only a concern on the Ethereum blockchain, but here it can have a significant impact. You should expect to pay at least $50 in fees, which is a significant amount on top of a $250 NFT. Buying five instead of one, for instance, would lower your effective cost from $300 to $260 per NFT.

Buy multiples

I already mentioned it above, but being able to buy multiple NFTs in one transaction is a nice convenience and an added benefit in and of itself. Just be aware that most projects limit the amount of NFTs you’re allowed to mint.

Extra excitement

The excitement of buying something from a collection you like, but not knowing exactly what you’re gonna get, shouldn’t be underestimated. It’s like opening a pack of Pokémon or Magic cards and is arguably one of the most fun aspects of buying NFTs.

You might get lucky

An important contributor to the excitement is the opportunity to get a rare and valuable item from a collection. You might get lucky and mint an NFT that’s immediately worth 10 times what you paid for it and will make all your fellow collectors jealous.

Three ETHEREALS I minted during their launch, one of which is ranked #166 out of 12,345 NFTs (ref: rarity.tools)

Added rewards

Some new projects offer certain incentives to their earliest supporters, like a free airdrop, early access to upcoming drops, or even just a special role on Discord. You might need to participate in the “pre-sale” or mint early (e.g., the first 2,000 in a 10,000 NFT collection), but it’s definitely worth looking into.

Benefits of buying on the secondary market

There are plenty of reasons to favor the primary over the secondary market, and I personally like participating in new launches for all the reasons above. All that being said though, for certain projects and in certain situations, I still choose to skip the initial launch and instead consider buying on the secondary market. Here’s why.

Security

Now, with proper due diligence and careful selection of projects to mint, the risk of getting outright scammed is fairly low. But it’s still there. I’ve gotten scammed a couple of times myself. Seemingly legit projects with large communities sold out in minutes only to run off with the money and leave all their buyers with nothing. When you buy on the secondary market from a trusted and verified collection, you know you’ll at least get an NFT in return for your money.

The OpenSea marketplace highlights verified and trustworthy collections with a blue checkmark icon

Lower transaction fees

I know, I know, I just said that minting will let us save money on transaction fees, so what’s this all about?! Once again, it’s all about Ethereum. The more congested the network is, the higher the transaction fees. Because of this, it’s commonplace to see transaction fees go through the roof during the minting of popular new projects. The so-called “gas wars”.

To put things into perspective, I once tried to mint an NFT priced at 0.08 ETH and offered 1 ETH in fees to get my transaction through… And failed because I was outbid by other buyers. Which leads me to the next benefit of buying secondary instead of minting.

Don’t lose your fee

Not only can minting get highly expensive for popular launches — you risk losing your transaction fee without even getting an NFT in return. If a launch sells out before your transaction is processed, for instance, your fee may still be charged and you’re left with no NFT and a little less ETH in your wallet.

Canceling your pending transaction, as I did in the aforementioned example, won’t be free either. Since the network is likely still congested, it may actually cost you quite a bit. Losing money in gas wars is somewhat of a rite of passage for new people in the NFT space, but not one I would recommend if you can avoid it.

Fewer technical issues

It’s unfortunately still pretty common to see websites crash or smart contracts getting exploited by buyers during a mint. This will most often just cause some frustration and a lost opportunity, but you might also lose your transaction fee as described above.

The secondary market places are by no means perfect either and quite often struggle with their own issues. However, the risk of OpenSea or another marketplace crashing in the middle of your transaction is very low compared to a new website that suddenly needs to handle 1,000x its normal traffic.

Buy exactly what you want

While minting will give you that extra excitement and the opportunity to mint the most awesome NFT in the entire collection, you might also get unlucky and mint something you just don’t love the looks of. If you instead buy from the secondary market, you can pick exactly the one you want.

A few of the different Sewer Rat Social Club NFTs available on the secondary market (ref: OpenSea)

You may have to pay a premium though and especially for the rare items in the collection. However, I still choose this option when I know from the pre-launch sneak peeks that there are certain items I really like and others I don’t.

Buy NFTs with a track record

Let’s end with the longer-term perspective on the inherent risk of minting new projects. Even if the people behind the project aren’t actual scammers, they might still not be able to deliver on all their promises. Or maybe there wasn’t as much community support as you and they expected. When you mint a new project, you have no historical data, no track record, basically nothing but goals and promises to back up your decision.

Buying an NFT from a project and a team that’s at least had a chance to sell out, find its footing, prove that the 20,000 Discord members weren’t all flippers, and execute on a couple of items on their roadmap, is arguably a much safer bet than a new mint. You will most likely pay a premium, the size of which depends on how long you wait before pulling the trigger, but it may be worth it.

With that being said, a project with a 4-month track record is by no means a guaranteed success either, let alone one that launched a week ago.

It’s a common saying that 99% of the existing NFT projects will fail. In the end, it really comes down to your analysis and belief in the long-term viability of a project, whether it’s pre-or post-mint, as well as your risk tolerance, time horizon, investment strategy, and whether you’re buying an NFT for other reasons than financial gains.

Check out my other articles here.

7 Comments

I have recently started a site, the info you provide on this web site has helped me tremendously. Thank you for all of your time & work.

wow, awesome blog article.Much thanks again.

cailkamb b9c45beda1 https://coub.com/stories/2756578-hot-download-hana-studio-for-mac

vanndre b9c45beda1 https://coub.com/stories/2791250-beboncool-wireless-bluetooth-game-controller-manual-fixed

frejam b9c45beda1 https://coub.com/stories/2822785-samuelson-paul-economia-pdf-free-new

I am sorry, that has interfered… This situation is familiar To me. I invite to discussion. Write here or in PM.

What charming question

This very valuable message

It only reserve

Probably, I am mistaken.

http://mayandigitalartstudio.com/that/

I have been absent for a while, but now I remember why I used to love this blog. Thanks, I?¦ll try and check back more often. How frequently you update your web site?