Earlier this week saw the coverage of two stories which related to centralised bodies getting involved in crypto antics, however in those instances, we at least got a glimpse of what good can come from institutional bullishness (thanks to Arizona Senator Wendy Rogers).

In wake of such coverage, more crypto-come-authoritative action has come to surface, however this time around, it’s a double-helping centralised-scrutiny.

Further, this past week has not only seen the Internal Revenue Service (IRS) release its updated requirements on crypto-related tax returns, but also a crypto start-up’s hopes of being onboarded onto the Federal Reserve Board’s (FED) exclusive payment system come crashing down.

IRS Reminds Taxpayers to File Any and (Near Enough) All Crypto Activities

With the 2022 federal income tax return deadline (a.k.a. Tax Day) now less than three months away (with the exact date being Tuesday April 18th 2023), the Internal Revenue Service (IRS) has released a list of reporting requirements which regard those filing crypto-involving tax returns.

For background, the IRS is an enforcement agency which deals with matters concerning United States federal tax laws. Its crypto-related questions come in three forms- Individual Income Tax Returns (1040), US Tax Returns for Seniors (1040-SR), and the US Non-resident Alien Income Tax Return (1040-NR)- with each category being faced with the same all-encompassing question:

“At any time during 2022, did you: (a) receive (as a reward, award or payment for property or services); or (b) sell, exchange, gift or otherwise dispose of a digital asset (or a financial interest in a digital asset)?”

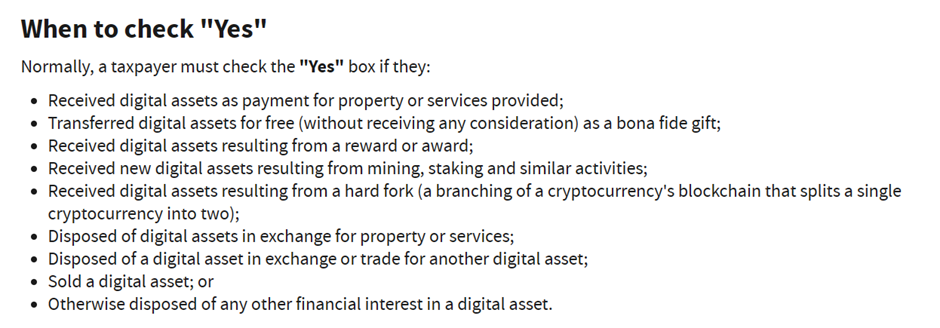

With tax filers required to answer ‘Yes’ or ‘No’ to the above question – “regardless of whether they engaged in any transactions involving digital assets” that is- the IRS has further outlined nine instances which constitute filers answering ‘Yes’. These essentially boil down to earning, receiving, trading, or selling any cryptocurrencies for monetary benefits (including when dealing with hard forks, mining, and staking).

And of course, those who answer ‘Yes’ are further required to report all relevant information tied to their ‘digital asset’ transactions.

That being said, there are certain circumstances that can facilitate crypto-goers answering ’No’- such as if someone has strictly held their crypto assets throughout the year, transferred crypto between wallets that the own, or purchased crypto using a fiat currency.

A final- and slightly unrelated- piece of trivia regarding this matter is that 2022’s tax return marks the first occasion in which the term ‘digital assets’ is used to denote crypto/NFTs- as previously, they were referred to as ‘virtual currencies’.

FED Rejects Crypto Bank’s Application to Join U.S. Payment System

One corporate entity most-certainly filing a crypto-natured 2022 tax return is Custodia (formerly known as Avanti), a Wyoming-based, crypto-centric banking platform that’s chartered through the state as a special purpose depository institution.

Per news which came to surface on Friday of last week, the bank had applied to become a member of the Federal Reserve System, however due to the bank’s proposed business model and focus on digital assets, the FED deemed it to entail significant ‘safety and soundness risks’ that it couldn’t take acceptance to.

More precisely, the application rejection stems through Custodia’s lack of a ‘sufficient risk management framework’ for addressing the ‘heightened risks associated with crypto’- with crypto’s (potential) ties with money laundering and terrorist financing also being of concern.

This particular case involving Custodia also saw the FED issue a more general policy statement which clarifies that banks that are supervised by the US central bank- with or without deposit insurance- are subject to the same limitations on activities, including those related to cryptocurrency. Per a press release, this is what it had to say:

“Today’s action would not prohibit a state member bank, or prospective applicant, from providing safekeeping services, in a custodial capacity, for crypto-assets if conducted in a safe and sound manner and in compliance with consumer, anti-money laundering and anti-terrorist financing laws”.

Although Custodia is said to be “surprised and disappointed” by the Fed’s decision- and whilst it may adversely affect those directly involved in the company- the ruling should perhaps be welcomed by the surrounding crypto community, as without such due diligence, we may get another Celsius, Three Arrows Capital, or FTX on our hands.

In-fact, due diligence with regards to Custodia’s role in authorised crypto ongoings is being handled on two fronts, as the self-dubbed ‘special purpose depository institution’ has also recently sued the Federal Reserve Bank of Kansas City for unfairly delaying the decision on its application for a highly coveted master account (which provides companies with access to Fed payment services).

Whether you deem the FED’s standoffish approach to crypto entities being justified or not, it’s perhaps a stance we must get used to, as earlier this month it published a report which outlines its averseness to crypto activities due to the space’s inconsistencies in ‘safety and sound banking practices’.