Thus far, 2023 has been a period of revival for Bitcoin, as after gracing the new year at a relatively low price of around $16,500, it surpassed the all-important $20,000 threshold two weeks later- and since, hasn’t looked back.

After lingering around the $21,000 to $23,000 price range over the past month, Tuesday of this week (February 14th) saw the coin begin to build a little more bullish momentum, with the $25,000 price level being broken earlier today (Thursday February 16th).

That being said, and at the specific time of writing, the largest cryptocurrency (by market capitalisation) has since retreated to a price of around $24,400.

In turn, the pump of the grandfather of crypto has prompted alt coins to also experience value increases, with Bitcoin’s most prominent crypto counterpart Ethereum reaching a $1,700 price mark for two consecutive days (rising around 9% in doing so).

Other notable alt coins also experienced price hikes, such as $MATIC- which is the native token of Ethereum Layer 2 protocol Polygon- climbing 12% throughout the week, as well as $APT- the native token of the Aptos blockchain- rising around 9%.

That being said, technical and fundamental analytical indictors have forecast that the next few months may be rather bearish for those holding Ethereum and other alt coins, as $ETH has printed a ‘death cross’ pattern versus Bitcoin.

In short, a ‘death cross’ occurs when an asset’s short-term 50-period moving average falls below its long-term 200-period moving average. In the case of ETH/BTC, a death cross was last observed in May 2022, which was then followed by a 27.5% price correction. Further, investors here were incentivised to move their investments into the more-secure asset of Bitcoin, with the collapse of the Terra blockchain and its $LUNA token catalysing bearishness for alt coins throughout such period.

In this latest case of an ETH/BTC death cross, similar short-term selloffs could take place, with the U.S. Securities and Exchange Commission’s (SEC) efforts to crackdown on crypto staking services- a key feature of many alt coins- serving as an added reason for investors to seek refuge in Bitcoin.

In turn, capital funds into Bitcoin and Ethereum-focused funds have responding accordingly, as per stats from the latest weekly report from European digital asset investment group CoinShare, Ethereum-based funds have attracted just $15 million 2023 thus far- a figure which pales in comparison the $183 million raised by Bitcoin-based funds.

Despite the immediate future perhaps not being so straightforward for alt coin holders, the stocks of mammoth crypto-related entities have also climbed in recent times, with Coinbase’s rising 3%, and major bitcoin holder and business software provider MicroStrategy’s increasing 2%.

With the controversial arrival of Bitcoin Ordinals- which essentially serve as the first NFTs on the Bitcoin blockchain- mining activity within such ecosystem has also increased, which in turn, has helped pump the stocks of many Bitcoin mining companies.

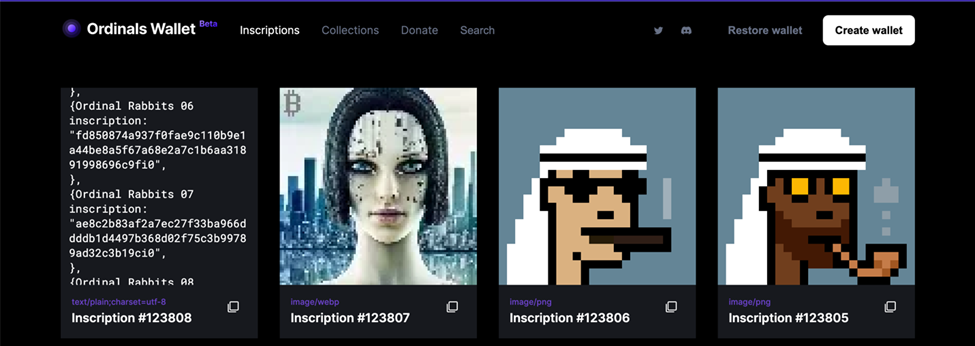

Bitcoin Ordinals Wallets

Staying on the topic of Bitcoin Ordinals, those involved in such protocol have, till now, had to deal with an inefficient and centralised tech framework when managing their newly developed digital assets.

That being said, with Ordinals now closing in on being a month old, multiple ‘wallet’ solutions that are tailor-made for the Ordinal protocol have since been launched.

The first to be discussed is the simply titled ‘Ordinals Wallet,’ which went live today (February 16th). The wallet allows users to receive, store, and view ordinals in one virtual space, with transfer, sending, inscribing, and buying/selling functionalities said to be on the way soon.

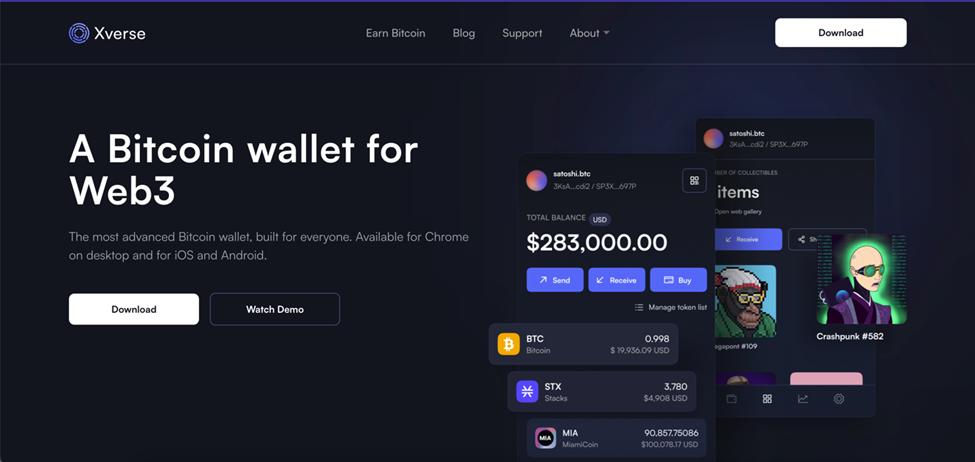

24 hours prior to the Ordinals Wallet going live, a similar ‘Xverse Wallet’ also launched. Self-dubbed as a ‘1st class support’ solution for controlling Bitcoin from ‘anywhere,’ the wallet goes beyond the functionalities of the Ordinals Wallet by actually allowing users to inscribe Ordinals on the Bitcoin blockchain. To do so, the platform removes the need for users to run a full Bitcoin node in order to interact with the blockchain meaningfully (which, in the process, requires a Bitcoin transaction fee).

The third Bitcoin Ordinals-oriented wallet solution is the ‘Hiro Wallet,’ which preceded both the ‘Ordinals’ and ‘Xverse’ wallets by rolling out its testnet on February 14th. Similar to ‘Xverse,’ the Hiro wallet works with Bitcoin NFT marketplace Gamma in order to facilitate Ordinal inscriptions, as well as the NFT economy of ‘Layer 1.5’ blockchain solution Stacks.

Of course, the introduction such wallets was simply a matter of time, as throughout Ordinal’s 3-4 week lifespan, over 123,500 inscriptions have already graced the Bitcoin blockchain- and despite many grievances from OG Bitcoin gatekeepers, many believe that such activity has fully cemented the arrival of NFTs on the Bitcoin blockchain.

With this in mind, it’s likely that more Bitcoin Ordinal-based wallet solutions will appear in the coming weeks/months, which, in turn, may cultivate a competitive and user-empowered market for developing the best solution.