Although it remains ambiguous as to whether the current bullishness in the crypto space is here to stay, it’s safe to say that in wake of a rather bleak 2022, 2023 has already served-up a much-welcomed dose of optimism in the space.

And with crypto’s long-term trajectory most-certainly being a function of what stances centralized authorities take, any actions regarding such traditional entities- be it good or bad- are always worth taking a look at.

With this in mind, this article will cover three of the most recent crypto-come-centralised encounters.

Arizona State Senator Advocates Bitcoin Becoming Legal Tender

Beginning in Arizona, its state senator Wendy Rogers has recently launched several bills which concern the future of cryptocurrencies in the state. In an outright plea for DeFi adoption, the stand-out bill in this case relates to Bitcoin becoming legal tender across the Copper State.

If the bill is passed, Bitcoin will essentially acquire the same status as the US dollar, meaning it’ll be an accepted form of barter for public charges, debt payments, and taxes/dues across the state.

For those who keep up to date with state-to-state crypto antics, such proposal will come as little surprise. This is because Rogers is by no means new to the DeFi bandwagon, as last year she introduced a similar- albeit unsuccessful- bill. 2022 also saw her take to Twitter to voice her concerns over central banks and their plans introduce ‘central bank digital currencies’ (often referred to as CBDCs) across the globe, as she tweeted:

“Centralized digital money controlled by the central bankers is slavery. Decentralized #Bitcoin is freedom”.

On a broader level, Rogers is also participating in introducing a bill which will see crypto become a tax-exempt property. If approved, a demographic vote in 2024 will decide whether tokens that don’t represent the US dollar or foreign currencies can become exempt from taxes.

Goldman Sachs Ranks Bitcoin as the ‘World’s Best-Performing Asset in 2023’

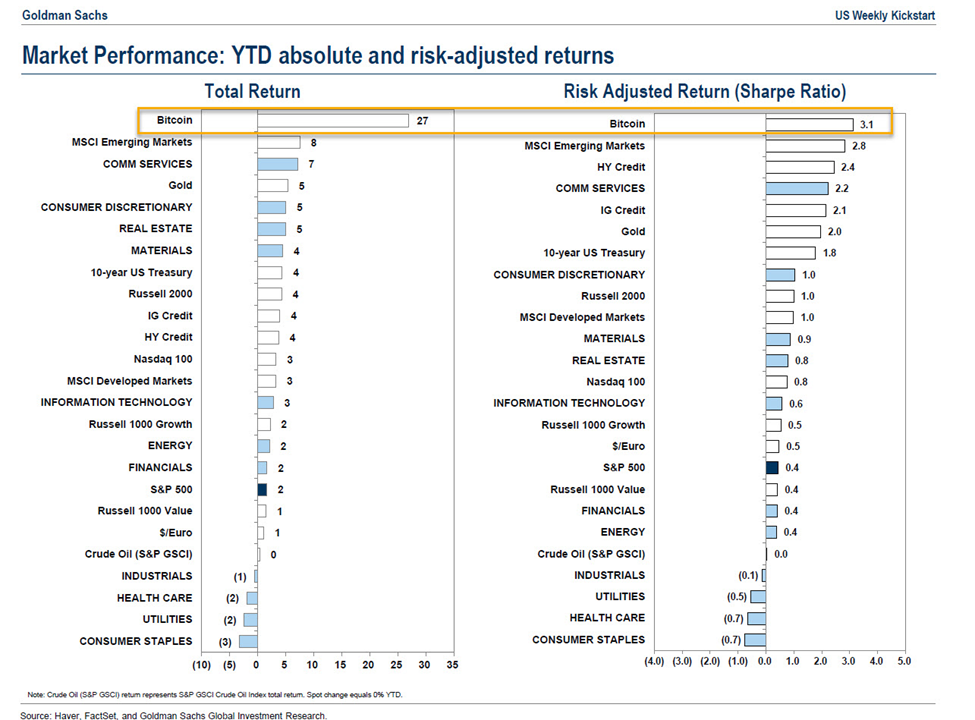

Bolstering Roger’s advocation for the holy grail of crypto is a recent report from traditional finance powerhouse Goldman Sachs. The report claims that Bitcoin is the ‘world’s best-performing asset in 2023’- with Roger’s explicitly referring to it when announcing her recently launched bills.

Such acclaim comes after the token continues to recover from the bear market-ridden year of 2022. At the time of writing, the asset’s price currently sits at a little under $23,000, despite being at as little as $16,195 in late November 2022 (stats per CoinDesk).

In getting more technical, the report- which was shared by dedicated Bitcoin social media account ‘Documenting Bitcoin’ on January 23rd- included stats such as the token’s ‘year-to-date return’ of 27%, as well as its risk-adjusted ratio of 3.1. Here, the token is said to have outperformed every other asset included in the report, such as real estate, gold, S&P 500, and the Nasdaq 100.

Dutch Central Bank Fines Coinbase

Despite such promising progress towards decentralisation, the early weeks of 2023 have still had time to serve-up a healthy portion of centralised enforcement.

This time, it’s the turn of Coinbase to take the wrath of traditional authorities, with the Dutch central bank (a.k.a. the De Nederlandsche Bank) being the issuer.

Here, the exchange’s European branch has been fined $3.6 million for ‘non-compliance’- i.e., for failing to register with the Dutch central bank under the Anti-Money Laundering and Anti-Terrorist Financial Act before offering its services in the country.

Getting into the nitty-gritty’s, the regulator claims that Coinbase has been operating whilst unregistered between November 15th 2020 and August 24th 2022, where within such timeframe, it enjoyed competitive advantage through not paying supervisory fees.

Despite obtaining the correct registration on September 22nd 2022, Coinbase is said to disagree with the fine due to it being “based on the time it took for Coinbase to obtain our registration in the Netherlands and includes no criticism of our actual services”. In turn, the company further believes that it “should not be penalized for playing by the rules and engaging in this process”.

The Dutch central bank evidently disagrees with such claims, as the $3.6 million figure is in-fact a mark-up from its original amount of $2.18 million- with the severity of the non-compliance, Coinbase’s stature as one of the world’s largest crypto exchanges, and the platform’s number of the Netherland-residing customers being the reasons for the mark-up. That being said, and in recognition of Coinbase’s intent to always complete registration, a 5% reduction was also imposed on the fine’s final amount.

Interestingly enough, such dynamic is almost identical to that of the Dutch central bank’s feud with Binance last year, as again, such case saw the fellow crypto giant be fined $3.35 million for enjoying competitive advantages through not being registered under the Anti-Money Laundering and Anti-Terrorist Financing Act.

Moving forward, Coinbase now has until March 2nd to object to the fine, with a company spokesperson stating that it’s “carefully considering the objections and appeals process”.