The FTX collapse has sent shockwaves through the industry, but the full impact is unclear as the trading firm’s intricate network of connections is still unravelling. Amid sharp sell-offs, the Solana ecosystem was among the worst hit. Their close ties and dealings with FTX and its subsequent collapse have reverberated through Solana, perhaps most acutely through its severe sell pressure on the price of SOL.

Recent Price Action

Initially founded in 2017, the Solana Foundation relaunched in the first quarter of 2020. And it rose to become one of the top 10 cryptocurrencies within a year. During the 2021 bull run, the crypto world witnessed its meteoric rise to an all-time high of $260. But the price started to tumble following the broader economic aspects.

In the aftermath of the FTX collapse, Solana suffered an even harsher blow. It plunged more than 65% in just ten days and has slipped by 95% from its all-time high in November 2021. Despite the modest improvements over the past few days, the SOL price is still being held back by the macro conditions of the broader market.

Total Value Locked

The total value locked (TVL) in Solana is another aspect that was adversely affected. The TVL refers to the value of all assets locked into decentralized finance (DeFi) protocols. Increasing TVL indicates more coins are deposited within the DeFi protocols while falling TVL shows investors are pulling their funds out of the ecosystem.

They were establishing itself as the leading rival when it came to DeFi. The chain was processing more than 3,400 transactions per second as opposed to Ethereum’s 15 transactions per second. TVL in Solana DeFi dropped during 2022 due to the declining value of SOL and the general market slump.

Then the FTX’s liquidity concerns ignited unease about Solana TVL, causing its decline to accelerate. According to data from DeFiLlama, TVL in the decentralized finance ecosystem of Solana stands at $281.73 million, signifying a drop of 97.23% from a peak of $10.17 billion in December 2021.

Further statistics from DeFiLlama show lending platform Solend, one of the top DeFi projects on Solana, lost 92.12% of its TVL last month. Solend now has just $22.2 million locked in the protocol compared to $280 million on October 31. The staking protocol, Marinade Finance, and decentralized exchanges Raydium and Orca have lost 61.80%, 59.45%, and 39.54% of their TVL over the past month, respectively.

There was a sharp reduction in active users across various protocols due to the widespread concern that the network may implode owing to its strong links to FTX. The close ties, compounded with general DeFi and macro sentiment have contributed to the decline in TVL across the Solana chain.

Analytics

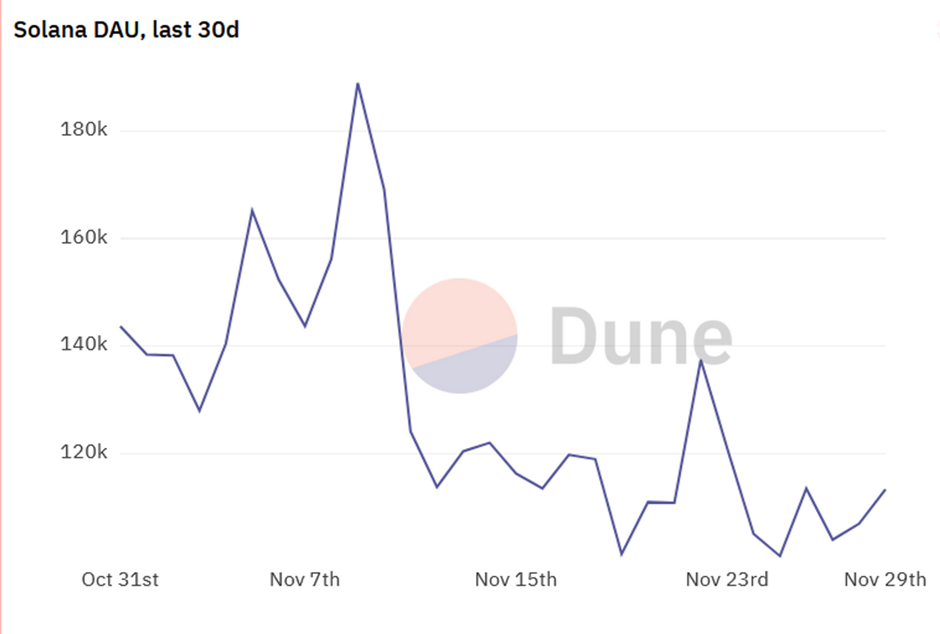

Dune Analytics data shows a decline in daily active users (DAU) across the entire network.

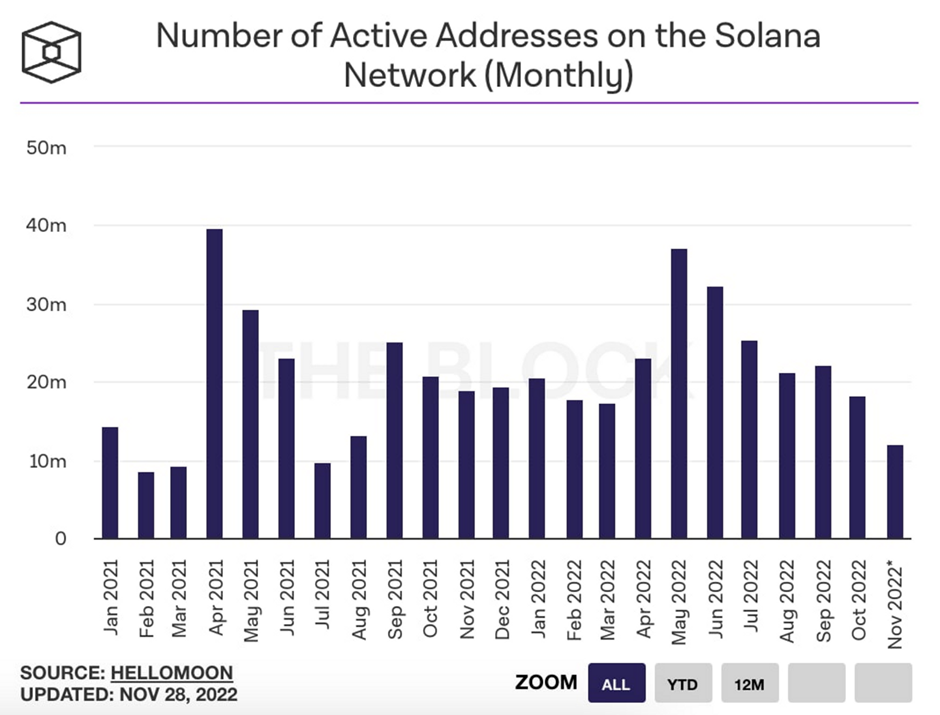

The total number of daily active addresses on the network is currently 11.92 million and is on track to reach 13.24 million, which would be the lowest total since August 2021.The number of new addresses and the non-vote transaction count follows a similar pattern. As of now, there have been 488 million non-vote transactions, which is on pace to be the fewest since May.

So far, the number of new addresses has reached 3.5 million. This month’s figure will likely be the lowest since September 2021. Stablecoins with a Solana basis also experienced an exchange halt during the controversy, albeit in some cases, it proved to be temporary. This shake of confidence has added to their reputation. In addition and in an act of risk management, Tether promised to transfer $1 billion USDT from Solana to Ethereum.

Concerns

Alameda and FTX own 58.08M SOL tokens, representing nearly 11% of the SOL total supply. These holdings put the bankrupt firms at the center of Solana-based decentralized finance. Following the filing of Chapter 11 bankruptcy protection by FTX, regulators may extend their reach to tokens that had close ties with the exchange, further plunging SOL.

There are also concerns regarding the massive amount of SOL that FTX and Alameda will have to sell to compensate their creditors. Many trading initiatives on Solana substituted wrapped assets known as “Sollet assets” for Bitcoin, Ether, and other foreign cryptocurrencies. The collapse of FTX, the issuer and backer of these assets, led them into a downward spiral and left many protocols with bad debt.

Due to a potential loss of faith, and the bear market we find ourselves in, SOL could plunge deeper. This is without the selling pressure from these entities. The future of Solana is in jeopardy. That said, since FTX and affiliated structures are in bankruptcy and a liquidation process, and such cases can last up to 10 years, it’s unlikely that Alameda’s SOL coins will go into the market anytime soon.

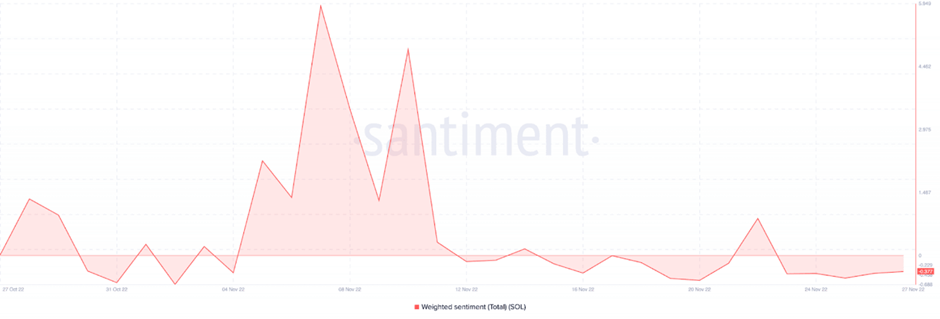

The narrative resembles the scenario with Mt. Gox’s Bitcoin. However, compared to 0.66% of the total supply of BTC, Solana’s case is different. A possible “black swan” of the size of 8.75% of the total supply looms over the SOL price. The weighted sentiment for Solana, also remains negative. Data from LunarCrush shows that during the past seven days, social mentions on the Solana have decreased by 28.3% and 9.3%, respectively.

Bullish Outlook

Despite the network outages and exposure to FTX, Solana did outperform its competitors in some areas. The number of transactions at Solana has remained relatively stable at about 19.9 million. In this sense, it has exceeded Ethereum and Polygon. Also, it topped other cryptocurrencies like NEAR and AVAX in the number of daily active addresses.

In fact, it produces more daily transactions than all of the rival L1s combined.

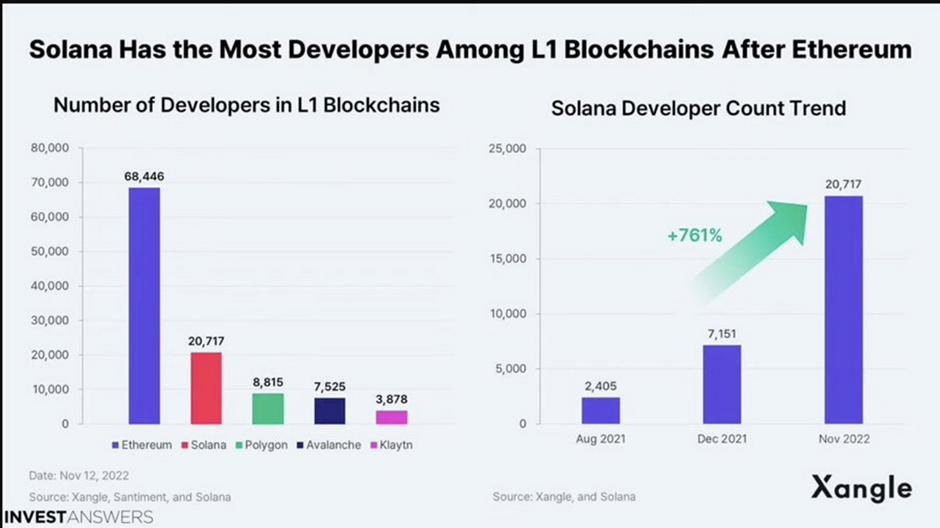

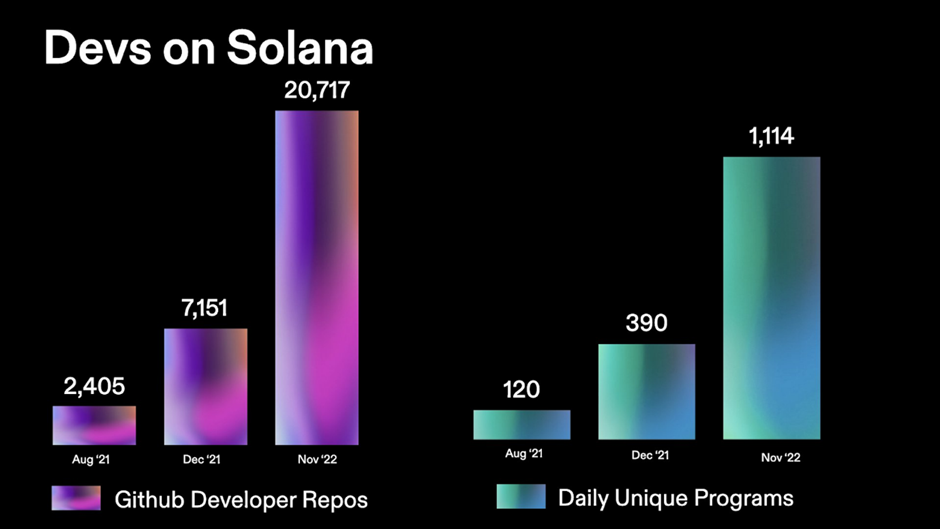

Despite SOL’s decline, developers have kept users engaged on positive milestones. They have an active and robust ecosystem of developers and builders. It has the second most developers behind the Ethereum blockchain.

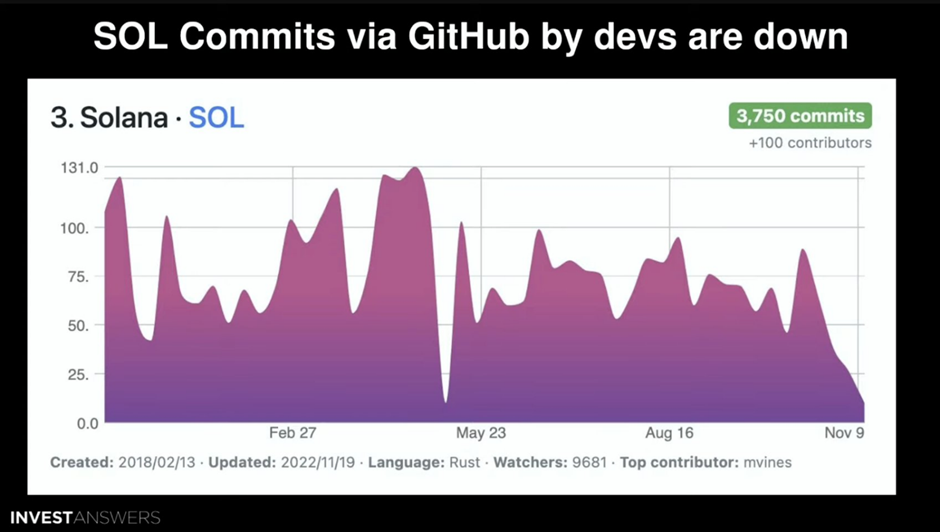

It is also number three in terms of daily GitHub commits, though the commits have been on the decline for a while now.

The number of open-source repositories and developer activity on Solana is on the rise, thanks to its effortless on-boarding process and growing developer education resources.

The Solana Foundation stated that it will “re-stake” the approximately 12.5 million SOL that it planned to un-stake during the following two epochs instead of selling or transferring them.

Theoretically, such measures might persuade investors that the SOL won’t dump further, serving as a liquidity safeguard against large sellers.

Final Thoughts

FTX and Alameda were the primary money funnel of Solana. And with the FTX collapse, Solana will be hard pressed for money. Moreover, Solana’s association with them could make its ecosystem unattractive to other VCs. It means only the Solana foundation and Solana Labs will invest in SOL ecosystem for a while, and their current cash reserves might not be sufficient. They could potentially resort to selling their SOL to raise capital, which could cause SOL to fall even further.

However a recent survey by @analyticalali showed that72% of teams had no exposure to FTX. This is much needed positive news, but the current sample size is 107 developers. Nonetheless it does give an insight on the potential exposure of teams.

Having said that, there are concerns about regulatory repercussions. The SEC is eyeing proof-of-stake cryptocurrencies, and Solana Labs is already involved in a security lawsuit. Solana could come under additional scrutiny since many regulators are investigating FTX and it’s dealings.

Polkadot, Near, Avalanche, and Cardano, are just a few of the several other smart contract cryptocurrencies vying for the dominance in the same critical crypto niche. And these projects are nowhere nearly as exposed to FTX as Solana. Add to this the possibility of Solana’s price was artificially inflated, $SOL may never reach those heights again.

Investing in Solana now is perhaps the riskiest option in the ‘riskiest’ market at the ‘riskiest’ time. Nevertheless, where there is risk there is usually ample reward.