The layer-1 blockchain protocol Solana had a 91.3% YTD fall due to a string of unfavorable events in 2022. It includes six network failures during the year, Solana’s connection to FTX, and a wallet breach to tune of $200 million. The accusations that Solana is not as decentralized as it claims generated further bad press, which led SOL to perform poorly in 2022. People were already sending wreaths to Solana.

But the truth is that the rumors of Solana’s demise have been grossly overblown. Solana witnessed a rally of almost 250% off the lows of $8.25 to $25. It was after being down nearly 95% from its all-time high of $259. The recovery wave was nothing short of a miracle. Or was it?

While a supportive tweet from Vitalik Buterin kickstarted the rally, the release of the meme coin BONK sparked more user engagement.

The BONK Airdrop Rekindles Enthusiasm

Some Solana ecosystem participants received an airdrop of a crypto token named BONK on December 24. This Shiba Inu-like token experienced a 400%+ value increase in the week following the airdrop, and this unexpected burst of activity has helped to rekindle interest in Solana. BONK was also the first meme token in Solana.

Solana’s market cap has consequently almost doubled since the start of the year. The biggest NFT marketplace in the Solana ecosystem, Magic Eden, also experienced record sales in December, totaling over 8 million $SOL. The collaborative launches of well-known brands like Toys’R’Us and Aston Martin may be partially accountable for this.

Solana re-entered the top-10 club on January 22 following several arduous weeks of pullback. Despite the current price spike appearing to be the outcome of speculation, the ecosystem at its core is still quite robust. This should be the central narrative, not the sideshow.

True, there is no denying that FTX/Alameda supported transactions, token values, and total value locked (TVL) throughout the Solana ecosystem. But they were only a single piece of the puzzle. The Solana ecosystem is still as robust as virtually any other L1 in terms of its network of builders, the ecosystem of applications, and a war chest of funding.

Are developers bullish on Solana?

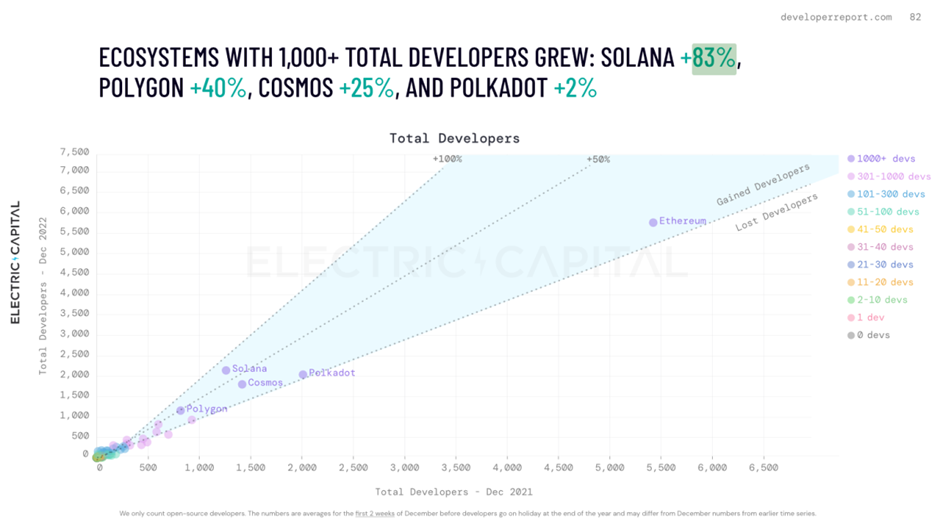

One of the developer ecosystems with the quickest growth in 2022 was Solana. A research report released on January 17 by Electric Capital reaffirms this case.

The report states that in 2022, more than 2,000 developers were working on Solana. Moreover, between December 2021 and December 2022, the developer count grew by 83%. In addition, Solana’s developer growth outpaces all other blockchain networks, second only to Ethereum.

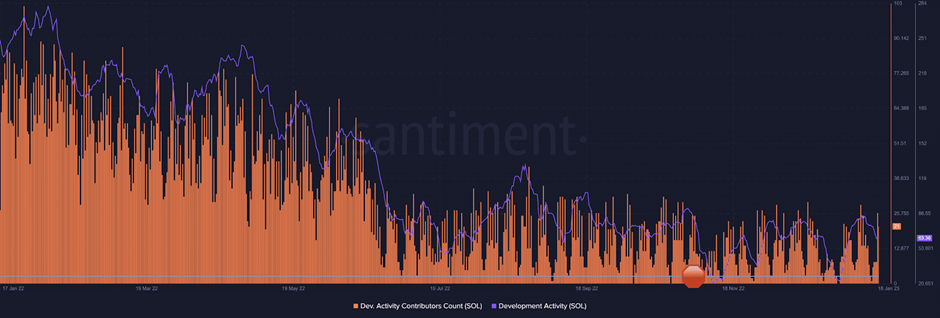

But this shouldn’t be mistaken as a sign that development activity increased exponentially. On the contrary, the bear market’s repercussions caused a significant decline in the metric over the past 12 months. The contributor count for the development activity followed a similar pattern.

Besides the developer count, Solana has seen a recent rise in the adoption of priority fees and local fee markets. It was visible throughout the network at the dApp and wallet levels.

Why is this relevant?

It underlines a rise in urgency or priority for those in need of such services, suggesting heavy traffic in the network. To put it another way, Solana is experiencing organic growth. Perhaps the hurdles encountered last year proved resiliency and aided adoption.

Are holes in the TVL of Solana closed?

SBF’s downfall did not just bring down FTX, a $32 billion bitcoin exchange, but also threatened to demolish the backbone of decentralized finance on Solana.

Serum was a key decentralized exchange platform and liquidity provider for the developing Solana DeFi ecosystem. It was formed in August 2020 by a group that includes the Solana Foundation, FTX, and Alameda Research.

For DeFi on Solana, its order book was essential since it was built into almost all the key DeFi projects on the network, including Jupiter and Raydium. And consequently, the subsequent crash and scandals put holes in the TVL of Solana.

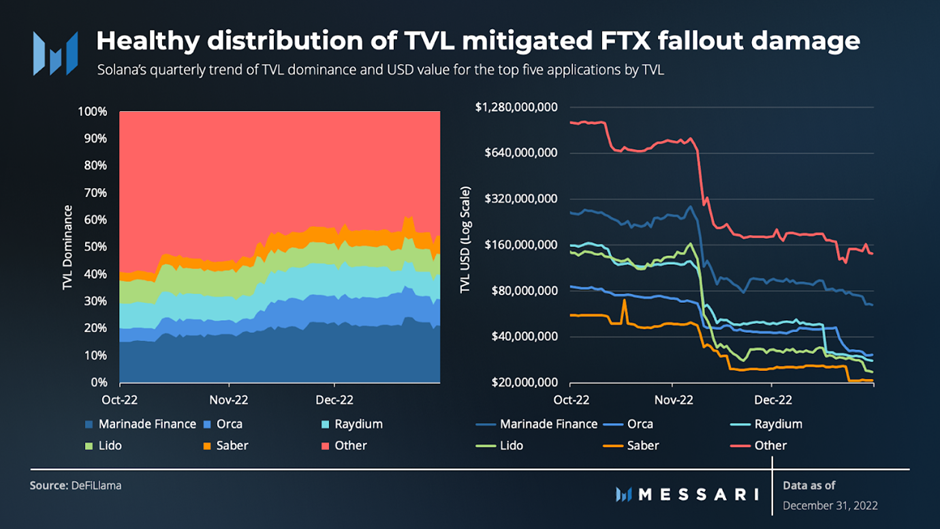

Nevertheless, Solana has recovered, although not to the levels before the FTX debacle. The consistent existence of a healthy TVL distribution across applications on Solana may have minimized further harm from FTX to the DeFi ecosystem.

Most long-tail DeFi protocols on the network currently have about 50% of TVL locked. Despite the challenging circumstances, integrations unrelated to FTX are under progress throughout Solana DeFi and are ready to accommodate and handle rising demands.

Solana’s total value locked in DeFi has risen by 33% from the start of the year. It has grown at a faster pace than the 26% overall DeFi TVL growth during the same time frame.

DeFiLlama estimates that the TVL on Solana is presently $265 million, with the Marinade Finance liquid staking platform serving as its dominant protocol. With an estimated TVL of $140 million, Marinade has a market share of about 52% in Solana.

With a 20.58% market share, the liquid staking platform Lido is in second position. Also, Lido provides liquid staking for SOL, with 2.3 million staked tokens totaling around $54.54 million.

Solana NFTs in a stormy market

Even though a few well-known NFT figures seem to be giving Solana the cold shoulder, there are still many positive aspects to it.

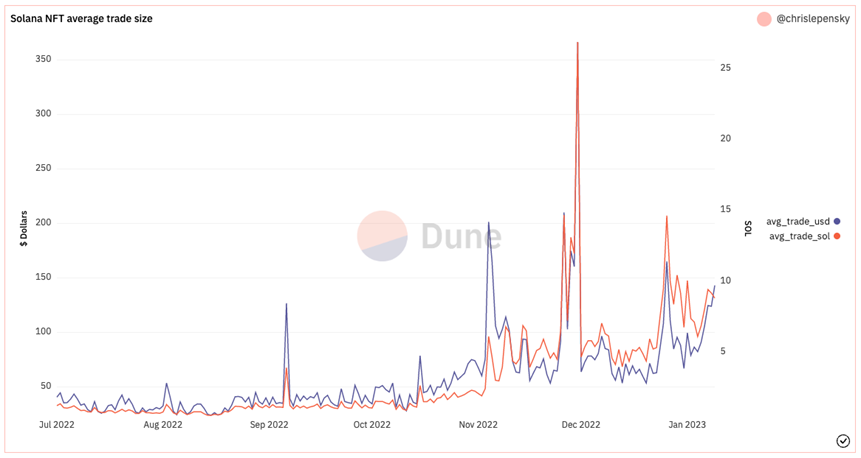

To start with, Solana is currently the second-largest player in the NFT market, and despite the collapse of the FTX and market meltdown, its performance in this crucial area has held up well. When examining Solana NFT transactions, increases in the average trade size—measured in US dollars and SOL—become evident.

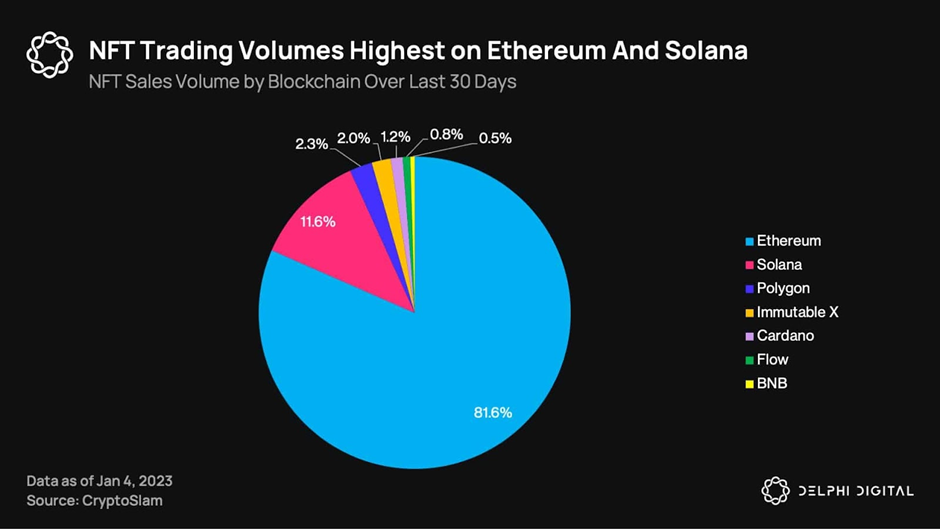

In terms of NFT trading across blockchain platforms, Solana comes in second. With an 81.6% share of the total NFT trading volume, Ethereum reigns supreme. According to data from Delphi Digital, Solana holds the second-largest slice of the market with an 11.6% share.

Unfortunately, the ecosystem suffered a setback when two of the most influential projects in DeGods and y00ts chose to leave Solana. The exit of top-performing projects sets a poor precedence for product developers trying to launch NFTs on the chain. Ethereum continues to be the preferred choice for leading brands and community projects.

Additionally, Polygon has begun to acquire momentum after establishing significant alliances with companies like Reddit, Starbucks, and Meta. Also, Y00ts decided to work with Polygon rather than Solana after being awarded a $3 million grant from Polygon Labs.

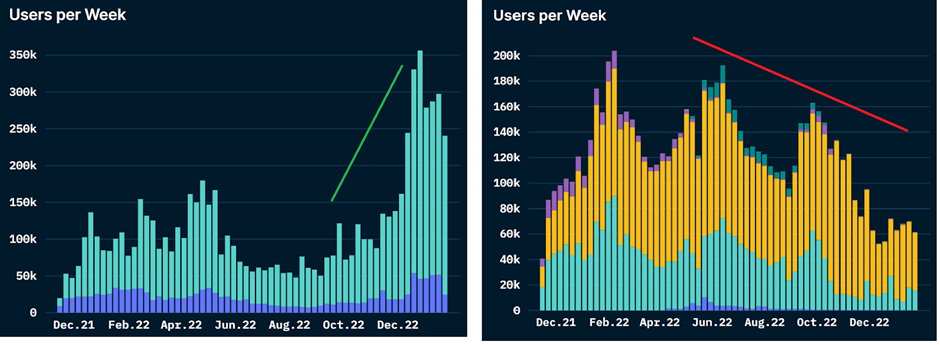

The divergence between the number of active users on Polygon and Solana is visible in the usage data from Nansen. While Solana’s usage has been trending downward since mid-2022, the number of active users on Polygon is surging.

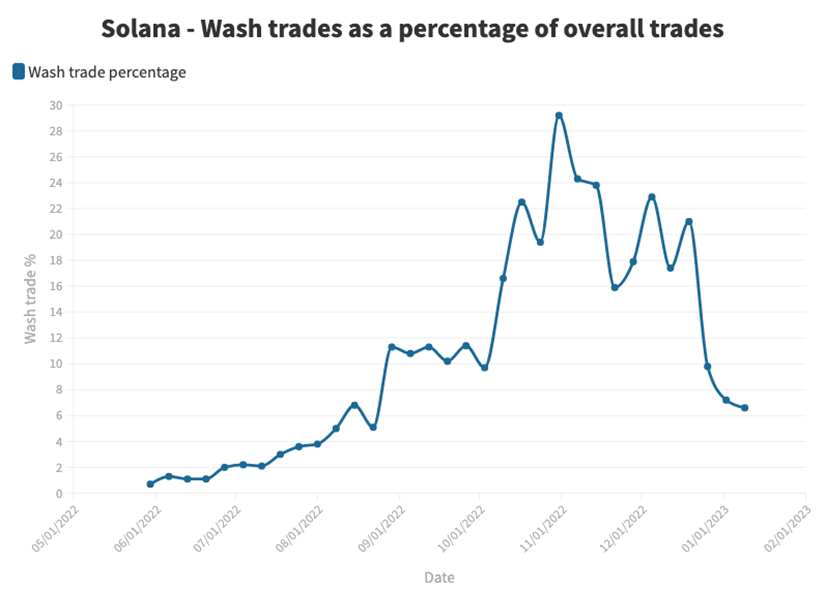

That said, wash trading on Solana NFTs declined significantly. Solana NFT wash trade reached its high at the end of 2022 but sharply dropped just before the new year. This type of activity is frequent among traders who want to record capital losses before the end of the year to reduce their tax liability.

As the second-largest network in secondary sales volume after Ethereum, Solana’s positioning and approach in the NFT market remain solid.

Future worries

Due to frequent and protracted network disruptions and breaches, Solana’s network lost favor last year. In 2022 alone, there were more than five outages.

Jump Crypto, a market-making fund, has created a backup validator client called Firedancer as a solution to the issue. It is yet to be tested in reality.

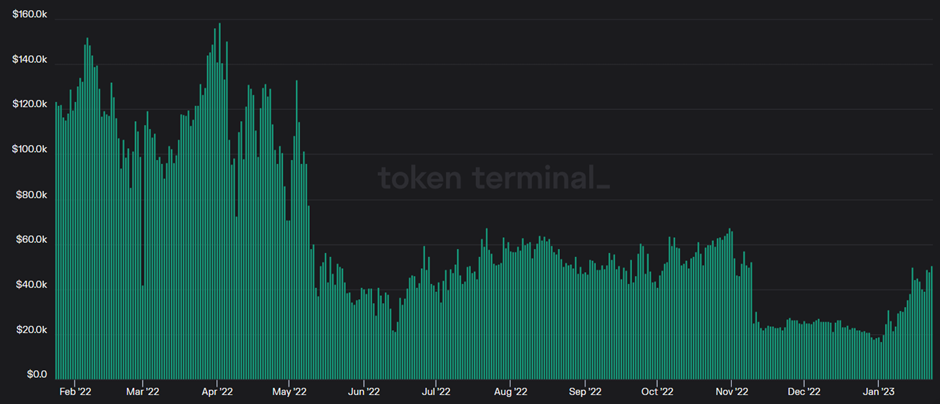

One of the most effective indicators for examining activity throughout a platform is the total network fees metric. According to Solana’s token terminal statistics, the number of weekly active users has been falling steadily since 2022, signaling a decline in network activity.

Along with outages, the ecosystem suffered from widespread hacks that damaged user confidence. One of the massive cryptocurrency attacks of 2022 was the $312 million Wormhole bridge hack. On another occasion, users’ wallets were drained of $8 million SOL.

FTX’s demise dealt the Solana ecosystem its fatal blow to trust because FTX-Alameda was the pillar of strength of the ecosystem. Around 58 million SOL tokens, or 10.7% of the whole supply of Solana, is held by the defunct venture capital firm and exchange. Of these, 6.7 million will be released each year until 2025, then 5 million until 2028. These holdings significantly raise the likelihood of a sell-off.

Hope for recovery?

Nevertheless, the fundamentals at Solana, as indicated by user base, network reliability, and transaction activity, are exhibiting signs of improvement. Although they haven’t recovered to pre-FTX crash levels, they are at least above the bottom.

There is hope for an upsurge with a little tidy-up around the edges.

Firstly, public perceptions about Solana DeFi must be bolstered. Solana was the fishing pool of SBF, and he went from being the Supreme Solana Shiller to the deadly Solana Killer. For Solana to flourish, this SBF perception must shift.

One could say Solana has been unfairly penalized because of its connections to FTX and SBF. Investors immediately fled the cryptocurrency after learning that he had supported and funded Solana. The token didn’t stabilize until the end of the year at the $10 mark. By Q2 of 2023, most of this stigma will be gone, allowing investors to value Solana solely on its merits again.

The next thing to fix is the downtime that Solana tends to experience. The Solana apes have been banging the nuts and bolts working on updates to remedy spam transactions as validators switched from UDP to Quick, giving them more control. Likewise, Solana has a unique paralyzable function that allows it to wrap network demand to keep gas surges contained in that zone.

Can Solana rise from ashes like a phoenix? The chances are high.

Conclusion

Considering the whole Solana ecosystem is crucial. It includes all Solana-based projects and decentralized applications, the Solana developer community, and NFTs created on the Solana network.

The Solana ecosystem is very active, and Solana made a lot of effort to reassure its developers that the network was not going away throughout December.

Although it can be challenging to assess the overall investor sentiment on Solana, the recent viral success of Bonk, the first-ever Solana meme coin, demonstrates how the community this year seems to be rallying around Solana. The meme coin has evolved from being a modest gesture of gratitude to Solana community members to becoming a news piece covered by the mainstream media as evidence of Solana’s rebirth.

Also, a multinational tour dubbed ‘Solana Hacker House’ is scheduled to begin in 2023. This tour featured 12,000 developers and toured 24 cities worldwide in 2022. Besides, the upcoming Firedancer validator client, (developed by Web3 development and high-frequency trading company Jump Crypto), is planned to boost networking throughput, efficiency, and resilience; and has an anticipated go live date sometime in 2023.

Finally, keep in mind all the projects Solana has planned for 2023. The official debut of Solana Mobile, which is the first-ever crypto phone in the world, is a crucial undertaking to keep an eye on.

The project is a vital component of Solana’s domination of the Web3 space, which Solana believes will be built around end-to-end mobile experiences. When combined with Solana Pay, which debuted in February 2022, Solana Mobile offers a compelling value proposition.

So, it’s not all doom and gloom, as Solana is developing into one of the chains with the loudest collective voices with hackathons and top-notch conferences. Solana will continue to release a wide range of projects, including network improvements, ecosystem developments, and community projects, to name a few.

The Solana network and ecosystem has a long and lively road ahead.