Coinbase’s newly launched Layer 2 network had its first trial by fire with the rise and fall of a meme coin known as $BALD. The core issue revolved around the sudden withdrawal of the liquidity from the meme coin’s pool by an anonymous developer, leading to a significant price drop. The rug-pull left many investors in a state of shock and disappointment and even sparked an array of speculations linking this activity to none other than Sam Bankman-Fried, former CEO of FTX, who currently faces house arrest.

The Launch of $BALD on Coinbase’s Base Network

On July 29, a pseudonymous developer known as “Bald” announced the launch of the $BALD token on Coinbase’s Base network. The token was built on the Ethereum ecosystem’s layer two blockchain, offering compatibility and novel mechanics that took advantage of Base’s new chain. The name “BALD” humorously referenced Coinbase CEO Brian Armstrong, who is famously bald. Little did anyone know at the time the rollercoaster ride that awaited them.

The Explosive Surge of $BALD

The news of $BALD’s launch spread like wildfire across social media platforms, attracting the attention of crypto traders seeking lucrative opportunities. One Twitter user, going by the handle @cheatcoiner, claimed to have acquired 2% of the token’s supply, sparking further interest and speculation. As word spread, the token’s popularity soared, resulting in an unprecedented surge in its market capitalization. Within 14 hours of trading, $BALD experienced a mind-boggling 289,000% increase, catapulting its market cap to $50 million.

The Curiosity Surrounding Coinbase’s Involvement

Coinbase’s association with the Base network added an extra layer of intrigue to the $BALD phenomenon. Although the launch on Coinbase’s open-source chain was unrelated to the exchange itself, the mere connection piqued the curiosity of crypto enthusiasts. Coinbase’s listings have historically exerted significant influence over token prices, creating a ripple effect across markets. Therefore, the early launch on Coinbase’s chain undoubtedly played a role in driving up the price of $BALD.

The Lack of Two-Way Bridging and Liquidity Constraints

Despite the excitement surrounding $BALD, the Base network faced several limitations that impacted its liquidity. The network only supported one-way bridging from Ethereum, with no official support for the reverse process. This lack of a two-way token bridge restricted liquidity and hindered the smooth flow of funds between the two networks. Additionally, the decentralized exchange (DEX) experience on Base was clunky and far from user-friendly, further impeding liquidity and trading activities.

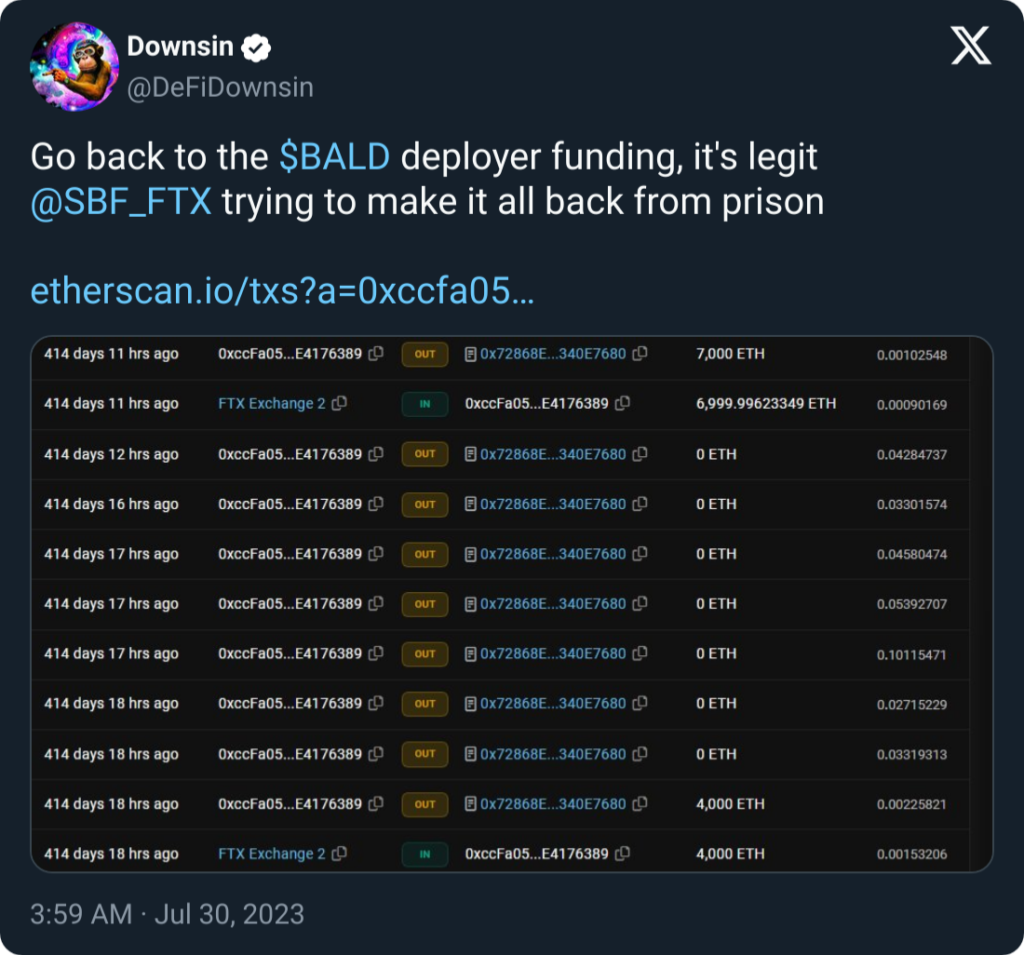

Behind the Scenes: Liquidity Injections

During the initial growth phase, the token’s deployer, known as BaldBaseBald, consistently injected liquidity into the pool. In the first 24 hours alone, BaldBaseBald added over 6,700 ETH, equivalent to more than $12.5 million. This large influx of capital was unusual for a memecoin on a new chain and led many to speculate about the identity and intentions of the deployer. Some even suspected that Brian Armstrong himself was behind the token, aiming to generate hype for the new chain. However, the moment BaldBaseBald ceased adding liquidity, the price of $BALD began to stagnate and decline. Then, 24 hours later, the deployer began acquiring $BALD once more, leading to a swift doubling of the price. But this resurgence was short-lived.

The Alleged Rug Pull and its Aftermath

The $BALD saga took a dramatic turn on July 31 when Twitter users began reporting that the token’s developer had removed a substantial amount of liquidity from the market. According to social media and blockchain data, the developer allegedly pulled 1,034 Ether (ETH), equivalent to approximately $1.9 million, causing the token’s price to plummet by 85%. However, the developer vehemently denied selling any tokens through a market order, claiming to have only added or removed two-sided liquidity. This denial sparked a debate within the crypto community, with some arguing that adding liquidity is, in essence, a form of selling tokens.

The Speculations around Sam Bankman-Fried

The unexpected ‘rug pull’ event triggered a whirlwind of speculations, with the spotlight falling on Sam Bankman-Fried, the former CEO of FTX. Some crypto enthusiasts and experts suggested that the wallets used in the ‘rug pull’ event bore a striking resemblance to those previously associated with Bankman-Fried.

The Evidence Pointing towards Bankman-Fried

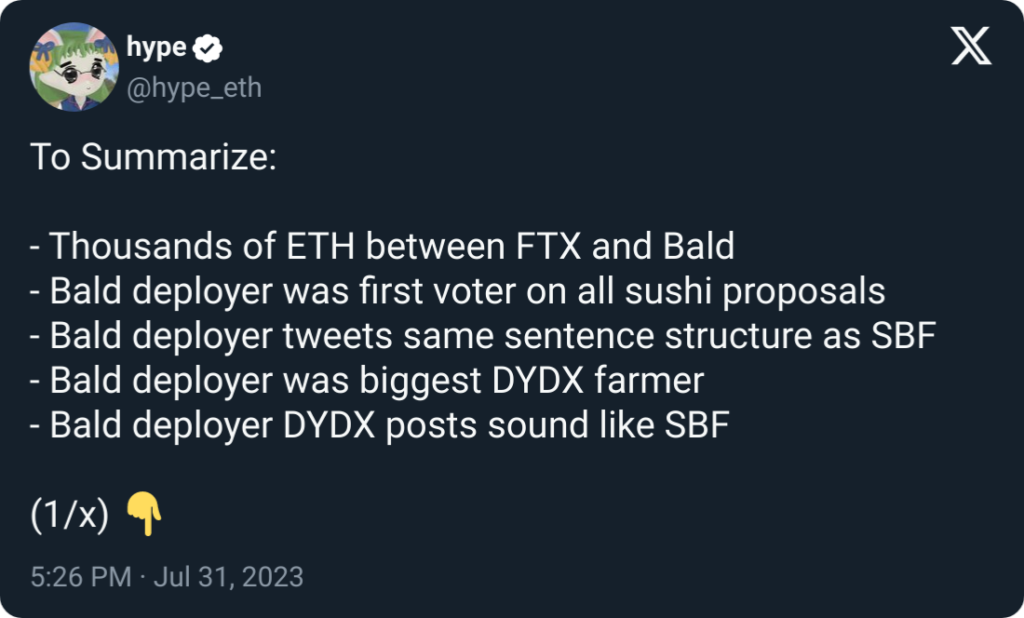

A series of observations and analyses led to the widespread speculation that Bankman-Fried might be involved in the BALD coin ‘rug pull’.

The mountain of evidence against SBF includes:

- The Wallet Address: Adam Cochran, a partner at Cinneamhain Ventures, pointed out that the wallet address in question had also been involved in the SushiSwap community years ago, with Bankman-Fried being one of the active participants at the time.

- Twitter Language: The use of specific phrases by the BALD Twitter account that were also found in Bankman-Fried’s Twitter posts raised eyebrows.

- On-chain Activity: The on-chain activity of the BALD coin aligned with Bankman-Fried’s court and bail dates, further fuelling the speculations.

- Reddit Investigation: A crowdsourced investigation on Reddit revealed that the BALD developer wallet had received deposits from FTX and Alameda over more than two years, with a balance of 12,331 ETH, worth about $22 million.

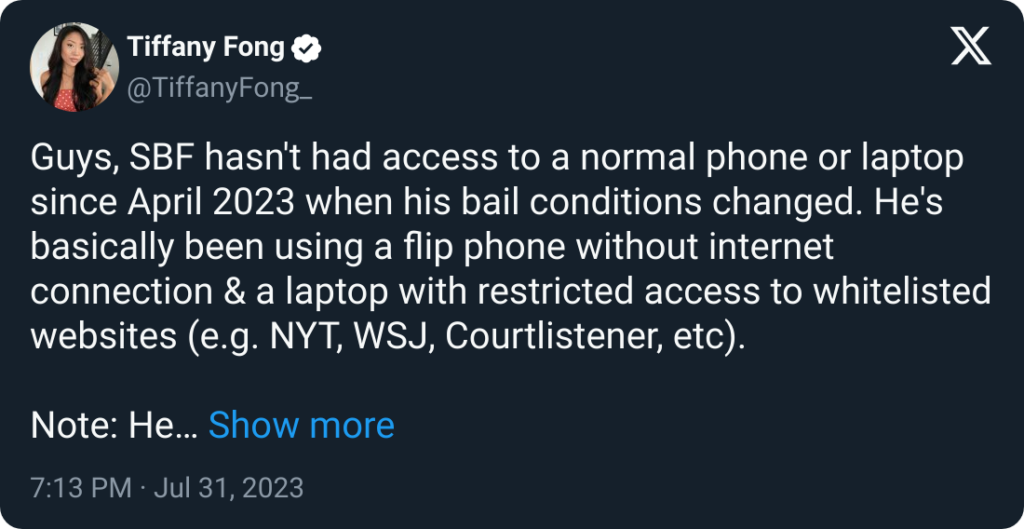

Although the crypto twitter was quick to blame SBF as the culprit, some were quick to point out that SBF is currently banned from most internet devices and only has access to a flip phone:

While this may be the case, with all transactions etched into the blockchain forever, it would not be out of the question to still believe that someone at FTX or Alameda is behind the rug pull based on wallet information.

The Future of BALD and the Base Network

While the BALD token episode has raised serious concerns, only time will tell the future of BALD and the Base network. As the Base network plans to officially release to users in August with a bridge UI, it could potentially attract more liquidity and create a more sustainable environment for its tokens.

As the crypto space continues to evolve, it’s vital for investors to stay informed and vigilant. The BALD token incident serves as a reminder of the volatility and risks inherent in the world of cryptocurrency.