The BendDAO and The Falling Sky Story

With the looming liquidations of BAYC and MAYC assets coming on BendDAO, I’m sure you have heard the story that the sky is falling if you have been active on twitter or in discord over the last few days.

The good news is that if you look more into it, just as in Chicken Little, all this appears to be, is a way to gain attention for the ones shouting that the sky is falling. So, with that being said let’s take a look into what is happening in the DAO and what it means for the DAO, the market as a whole, and most importantly you as an average NFT degen.

The best thing that you can do in a situation like this is to not instantly believe everything that you see influencers tweeting, and start by doing the research on your own. The good news for everyone that does not want to take that approach though is that I have already done it for you.

Let’s start by taking a look at how this will affect the DAO and how they could possibly cover the collapse of so much debt at once. The easiest way they are going to be able to cover it is the simplest way that most people don’t have the restraint for, and that is that they have not over-leveraged themselves in any way. I am a numbers guy and we could have limited all of this current fear in the market by simply looking at the numbers.

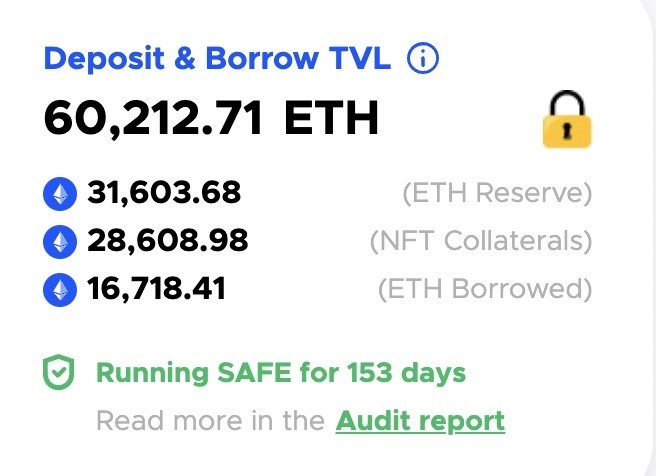

Currently, the BendDAO has outstanding loans at a valuation of 16,718 eth that they have distributed to the community, and the DAO currently holds 1,005 blue chip NFTs that at the current floor prices are valued at 28,608 eth. So just based off of those numbers the DAO is still in profit at current prices.

One of the best things the DAO does is it only loans eth at roughly 40% of the assets perceived value, for example, the current BAYC floor is roughly 71 eth and the highest loan you can receive is 26 eth. Using that math, most of the apes that are currently being liquidated were only loaned between 40-50 eth.

As these liquidations begin there are also many fail safes in place to make sure that when sold they will still be profitable as a DAO. Any bid being placed must meet the following criteria: Bids must be more than 95% of the floor price, bigger than the total accumulated debt, and higher than the previous bid plus 1% debt. Unfortunately, that means we won’t be able to get apes and mutants for 1 eth through these sales anytime soon, but it does lead to the question of what happens if someone isn’t willing to pay these prices, but luckily the BendDAO has a plan in place for that as well.

The beauty of who how BendDAO has been set up to handle this is that unlike other loan platforms this is not peer to peer loaning, but instead the DAO is taking on the brunt of the risk here, and they are willing to accept that if no one is willing to step up and buy said asset. They will be willing to hold that asset until a time when the market recovers as shown here from an excerpt from their liquidation FAQs:

“In this case, the platform only has a temporary floating loss and no actual losses. Either the borrower will repay the debt at some point in the future, or after the market price recovers, some liquidators emerge to take part in auctioning off the debt.”

Now I am sure you are asking yourself how can they possibly be willing to set on that much debt long term, and I again will refer you to point number one of them not over extending themselves, as they currently have an evaluation 31,603 eth in liquidity at their disposable, so not only are they currently sitting on almost an equivalent amount of assets, but they have two times more liquid capital than debt, so even if there is a short term downside in the assets they have more than enough capital on hand to do what they need through any of the turbulence from liquidations.

Now onto the more important parts of what this means for the market and for you personally. It is no secret that the market as a whole has not been what it was at the peaks of the bull run, but overall, the impact that this will have on the market is about the same as if a few owners decide they want to list their NFTs for sale, these liquidations are not going to trigger a massive death spiral that leads BAYC to 0, and if it does, I will be buying as many of them on the way down as I can.

More of what this is going to do is to provide some amazing buying opportunities to acquire some grails for cheaper than floor prices, as we have already seen quite a few auctions come up, we have yet to see any go unbid or not be rebought by the original holders. Even though the market is not as liquid as it once was, it appears that most degens are in the same mindset that this is more of a buying opportunity than a press the panic button situation. But even if the buying does come to a halt as more assets come out don’t expect to see them on the floor of opensea anytime soon.

What does this mean for you personally in this situation? It means a lot less than your favorite influencers want you to think. Unless you are looking to buy or are someone with eth staked in BendDAO then there is nothing to worry about. Even if you have eth staked in BendDAO I wouldn’t even be concerned either from this situation.

The only downside of it is the liquidity from the sold assets won’t be directly flowing back into the market, so don’t expect any sweeps of cryptodickbutts from BendDAO, but do expect the assets to flow into the hands of some collectors at prices that people would have been dying to get a few months ago.

Always remember in the NFT market to do your own research, verify the sources of information, and most importantly, don’t trust everything you read on-line. This isnt the first time we’ve heard influencers shouting the sky was falling, and I highly doubt it will be the last. But the best thing you can do is to remember who is shouting, the sky is falling so that next time you will know who is just engagement farming.

Check out my other articles here.