NFTs and Bitcoin haven’t previously been things you’d say in the same sentence. In fact, they almost reflected opposite opinions of the Web3 space for quite some time. Bitcoin was full of store-of-value maxis who thought NFTs were a fool’s game. NFTs were full of project fanatics who believed the Bitcoin blockchain was an old, retired grandfather who shouted at the neighborhood kids and mumbled about the “good ol’ days”.

The internet always has a habit of bringing people together; lately, all the buzz has been about Ordinals. What’s an Ordinal? Why am I using the words “Bitcoin” and “NFT” in the same sentence? Will there be any section of the space that wants to talk to me after I complete my synopsis? Probably not, but let’s dive in!

What is an Ordinal?

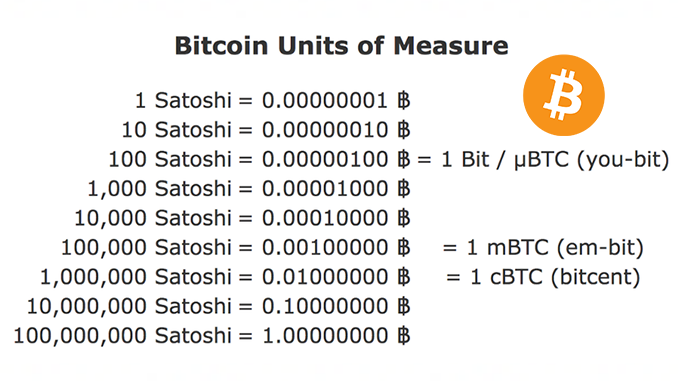

In Bitcoin, an Ordinal is a new concept. To first understand an ordinal, we must understand a satoshi. Other than the lovely Carmen Sandiego character who founded this beautiful chain and space, a satoshi is also a denomination of Bitcoin. Specifically, 1/100,000,000 of a Bitcoin, please see the below chart from https://discover.luno.com/what-is-a-satoshi-bitcoin/ for a clearer, visual representation.

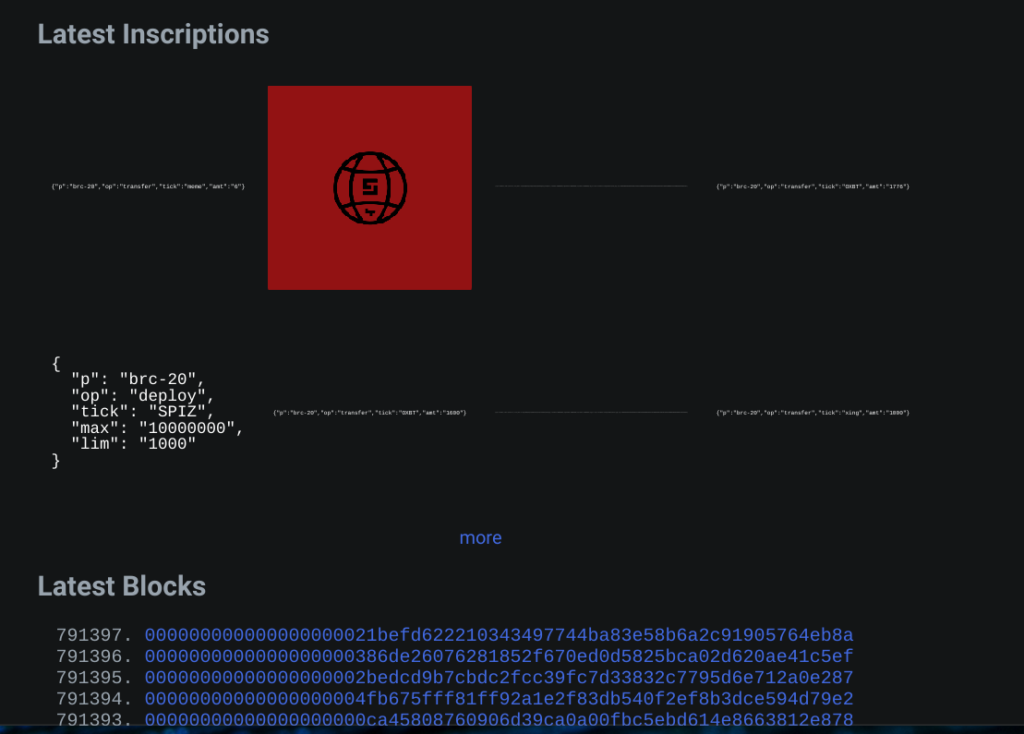

So now that we’ve conceptualized, kind of, how small a Satoshi is, let’s discuss Ordinals. So the name Ordinal comes from ordinal theory, which is the process of assigning serial numbers to individual satoshis. According to the official site, ordinals.com, the serial numbers are large and specific to each satoshi.

Ordinals require no sidechain, overlay, or anything else besides the existing Bitcoin blockchain and token as they already exist. By assigning individual serial numbers, each satoshi can be tracked individually. Ordinal Theory also allows for each serial number to have off-chain content ascribed on-chain to a satoshi. The collectable itself is popularly called an Ordinal in common discussion, although ordinals.com refers to them as “digital artifacts”, which we all know is way too many characters for degens to type furiously into their keyboards.

Why’s It Called a “Digital Artifact”?

Alright, well it’s clear to us all what this is, right? Images, videos, or other collectables inscribed on a blockchain…sound familiar? Almost as if just about every major chain that’s come after Bitcoin has some type of name for this…

Yes, “Bitcoin NFT” is a phrase we could use. Ordinals deliberately don’t and they also explain why. First off, creating a new concept enables you to learn from the mistakes of those who have come before you. Does everyone remember the bull market when NFTs on Ethereum were going for six figures and normies were watching the news wondering why the internet had gone to hell in a handbasket?

The phrase NFT now has connotations and comes with a reputation that proceeds it. Digital artifacts don’t ring any bells about $100,000 JPEGs of apes to the general public, so its publicity is a little easier to sell, and Bitcoin has that flexibility after waiting so long to introduce Ordinals on-chain. For a long time, nobody thought collectibles would make it to Bitcoin’s blockchain.

Compare, Contrast, and Shut Up

Alright, alright, fine…we’ll get to why you’re here. How is this technically different than an NFT? Let’s use Ethereum NFTs as an example, given they’re the largest volume and market cap.

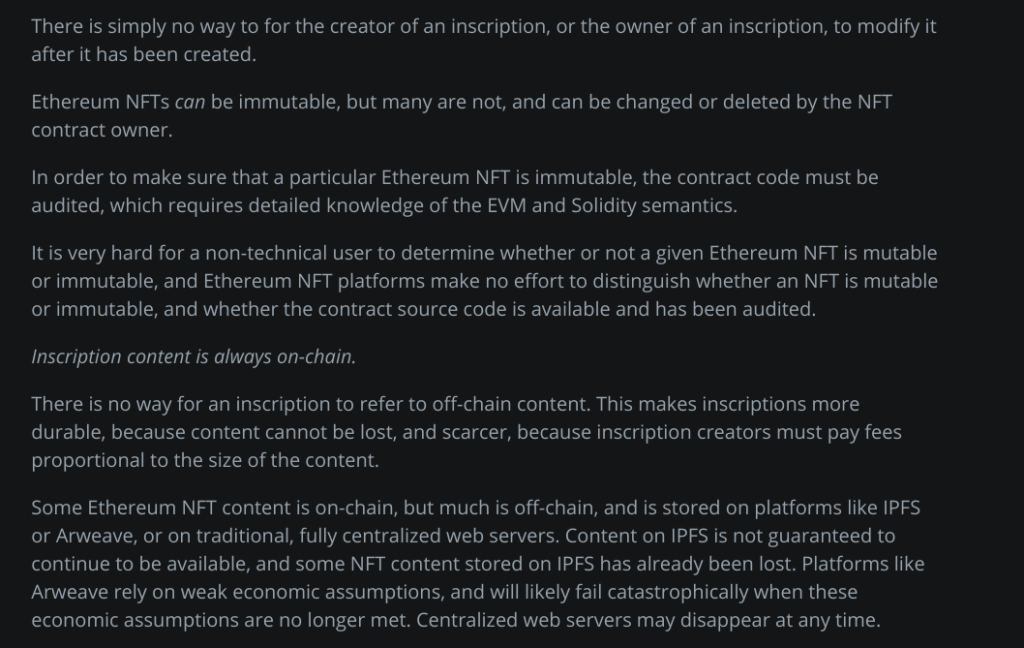

Well, for starters, satoshis are assigned an inscription that is embedded into the satoshi on the blockchain. Permanently. Have you ever had your contract owner of an Ethereum NFT update the art? That won’t happen for Ordinals. It’s a bit technical – ordinals.com explains better than I could in my own words.

So, essentially, Ordinals are forever. This level of permanence seems to be commonly popular among degens who want to make their mark on the space.

Ordinals are also easy to track on-chain. Ordinal serial numbers are assigned in the order the satoshis are mined. So, if I mine three satoshis and my neighbor mines two, my satoshis would have ordinal numbers that fall directly in front of my neighbor’s. The same logic applies to transaction fees – take out the numerical string that’s paid to the network operator, as those satoshis go there, and continue to the next portion of satoshis.

Of course, this whole process is still new, so creators of content that want to release their work on-chain need to weigh the pros and cons about where they’re deploying their efforts. It is emphasized on ordinals.com that the decentralization of money is still the top priority of Bitcoin, but Ordinals can help in a few ways.

For example, It proves a known use case by other chains that many doubted for Bitcoin. It provides additional demand for Bitcoin and satoshis, which helps to bring further financing to the network. It uses Bitcoin’s status as the top token and blockchain in crypto, along with the permanence of inscription compared to generally mutable NFTs on other chains, as a selling point for artists to have the best chance of long-term artistic preservation on-chain.

Tell Me How to Buy One!

Well, there’s not just one way to do it. Here is what I have found in my self-educating.

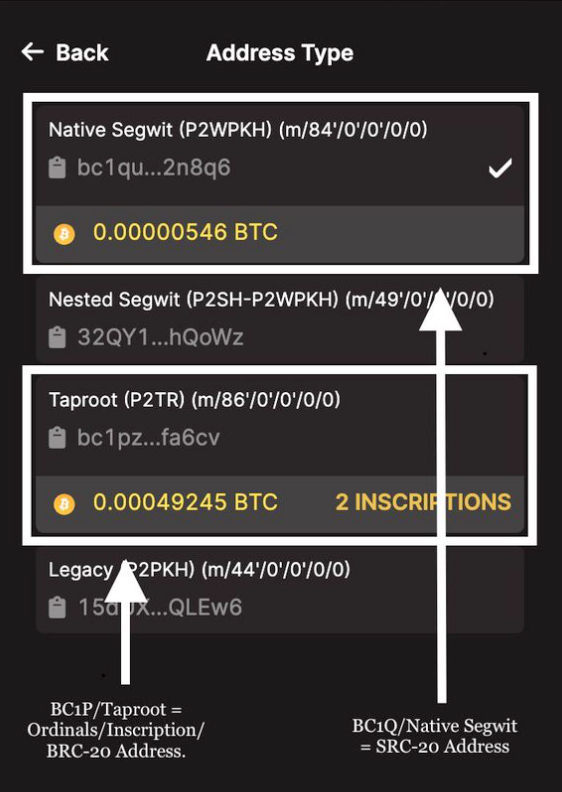

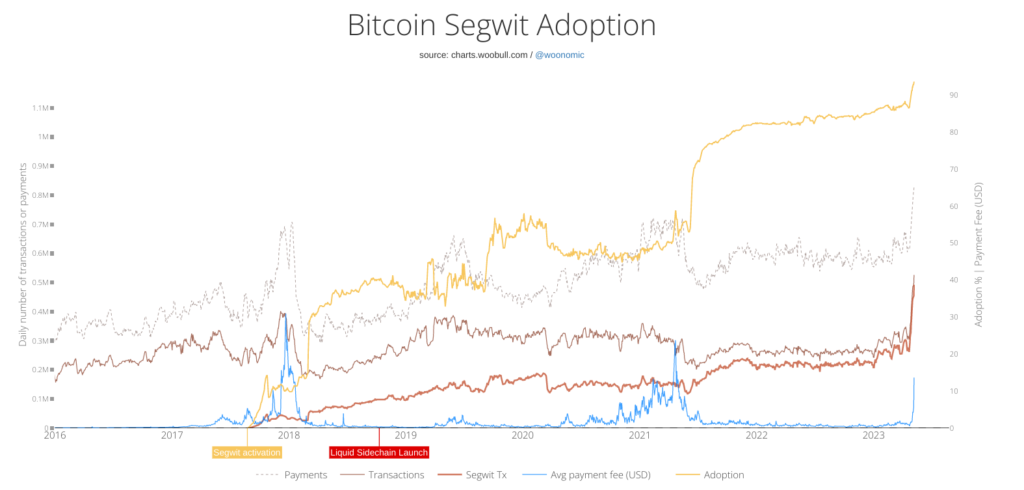

First off, your local BTC account may not be prepared to handle Ordinals. Even if you aren’t a hardcore Bitcoin maxi, if you hold any of the world’s largest token by volume anywhere in a hard wallet, the phrase “Native Segwit” may look familiar to you. It’s likely the type of address you currently hold your standard BTC tokens and was the name of the active protocol soft fork engaged in mid-2017.

Unlike Ethereum, Polygon, Solana, Avalanche, and other chains that host NFTs, Ordinals require a different type of address, called “Taproot”, as seen above. Not every UI that you interact with to hold your Bitcoin is capable of generating a Taproot address yet, as the Ordinals technology (along with BRC-20 tokens, which is a whole other rabbit hole…) is quite new. Taproot was originally a soft fork upgrade to the Bitcoin protocol designed to improve privacy, flexibility, and scalability.

Wen Taproot?

The Taproot soft fork was integrated into the Bitcoin blockchain protocol in 2021, specifically at block 709,632. This opened the future development possibilities that allowed for Ordinals.

First suggested by developer Greg Maxwell back in 2018, the Taproot protocol update not only laid the groundwork for faster processing times and additional blockchain capacity, but paved the way for many added protocols build on the Bitcoin blockchain, including Ordinals.

How 2 Taproot? Where Taproot?

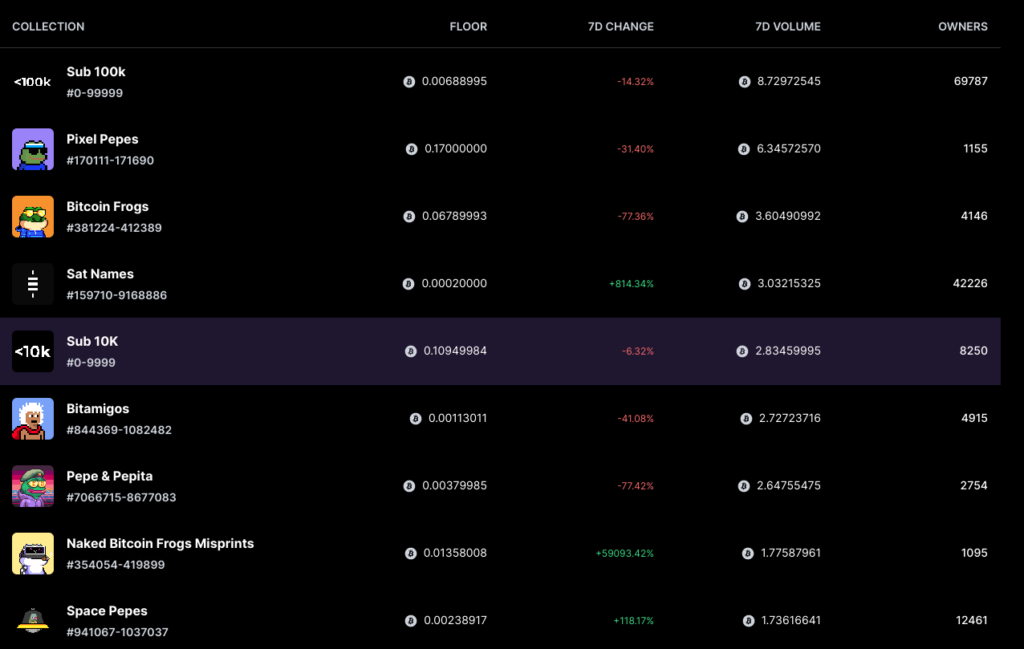

Do not stress; there are Bitcoin-native wallet interfaces that have been created to explore this further developed Bitcoin ecosystem. The Ordinals Wallet, which can be found on their website and Twitter, appears to be Taproot native and the website even contains a marketplace where various Ordinals collections can be found listed along with their ordinal numbers to signify where in the blockchain the collection exists.

Hiro Wallet, also seemingly Bitcoin-native, supports the broader ecosystem that Taproot has brought to the Bitcoin blockchain. Hiro can be found on their website and Twitter.

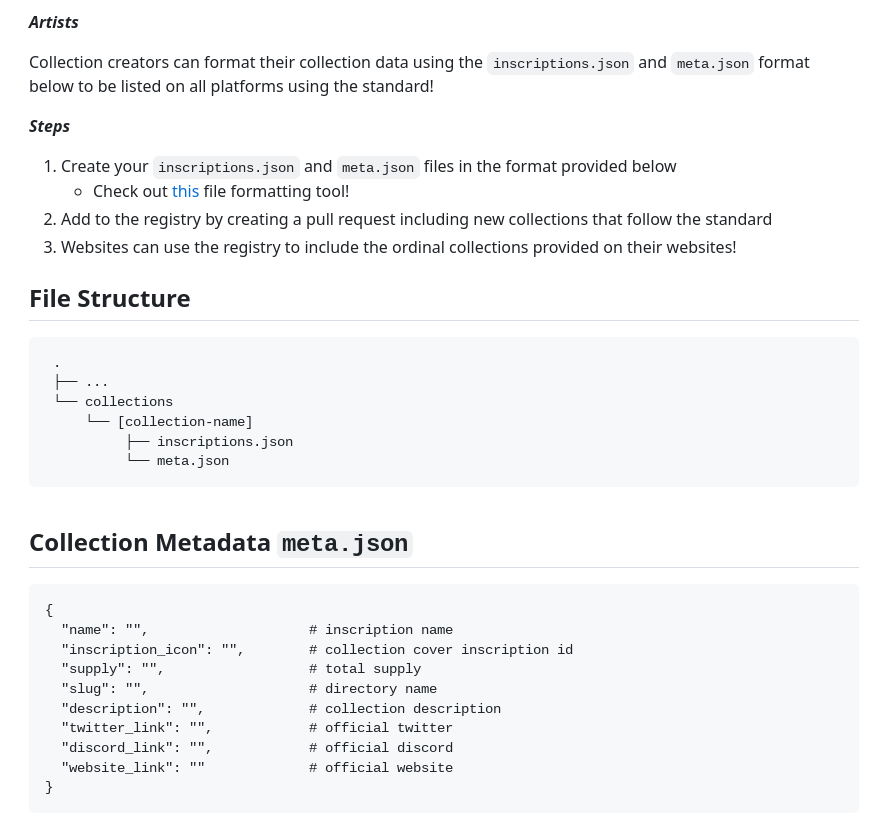

Artists have a little more difficult time. Platforms like Ordinals Wallet and Hiro Wallet have created very friendly UIs for degens who want to purchase Ordinals. In order to launch a collection on Ordinals and seemingly through the Ordinals Wallet marketplace, it’s a little more complex. The following instructions are courtesy of https://github.com/ordinals-wallet/ordinals-collections.

This is hardly all of the code-heavy directions (in fact, it’s just the first section of examples), but you get the idea. It’s not as friendly of a process and developers in this arena are going to be in demand by artists who want to take advantage of the scale and higher relative chance of permanence that Bitcoin and its blockchain can offer to them.

Legacy and Purpose

Alright, so right now, Ordinals are very developmental. The collections being traded are the first collections. The whole space feels very, very late 2010s on Ethereum, with everyone hoping to snag whatever the Bitcoin equivalent of CryptoPunks will be.

The truth is nobody knows and there’s a lot of degen speculation going on in the Ordinals space right now. However, the longer-term applications of having Bitcoin function as a broader blockchain than simply holding monetary value and providing hard money in an anti-inflationary mechanism are promising for the ability of the world’s largest token to retain its status atop the mountain.

Bitcoin developers seemed to look to other chains for inspiration, even if the concept of publicly admitting ERC-20, ERC721, and ERC-1155 tokens were an inspiration may be a tough pill to swallow. Despite not leading the pack by any means on digital collectibles, by taking a wait-and-see approach to innovation while being able to mold Bitcoin’s protocol to adapt to future concepts, Bitcoin can continue to both enjoy its mainstream status in the world of crypto, as well as work to shed its reputation of being an outdated chain for developers to build on.

In the meantime, explore some Ordinal wallets and marketplaces and see what you think. The nice thing about being a collector and consumer is that you can compare and contrast your experiences across chains. See what you think and be sure to let us know on Twitter what your thoughts are about Ordinals, the current state of the market, and how your digital collectible experience on crypto’s beloved grandfather chain has shaped your opinion of on-chain development in the space.