Although many industry players predicted cryptocurrency to have a lackluster year, with a focus on development and a price hovering between $12,000–$20,000, the value of Bitcoin unexpectedly increased throughout January.

It still falls well short of the cryptocurrency’s record high of $68,990 set in November 2021. However, it has given traders and investors grounds for some optimism.

Between January 20 and 21 Bitcoin gained 11% in 2 days, reaching $23,000, defying bears’ forecasts of a decline to $20,000. What’s more noteworthy is that, according to data from a crucial stablecoin premium indicator, the spike manifested in demand from Asia-based retail investors.

On January 20, $200 million worth of Bitcoin (BTC) returned to Binance- similar to January 13, when BTC increased to almost $21,000. The transfer is predominantly institutional, given that it is more than $10 million.

Another positive development came on January 20 after Christopher Waller, the governor of the US Federal Reserve, reaffirmed the market’s expectation of a 25 basis point interest rate increase in February.

Do these and other probabilities point toward a rally to $24,000 or perhaps even $25,000?

Why did BTC rise?

According to analysts, several variables, such as a greater probability of lowering interest rates and whale buys, are behind bitcoin’s New Year’s gain.

There are also other elements at play.

The price decline has forced out several bitcoin miners. The dip in price and rising energy prices have put pressure on bitcoin miners, who utilize powerful processors to validate transactions and create new tokens.

That is historically positive news for bitcoin.

These entities are among the market’s top sellers because of the enormous amounts of the digital currency they amass. Much of the remaining selling pressure on bitcoin is lost thanks to miners selling their holdings to settle debts.

Besides, more recently, the “difficulty” of the bitcoin network has risen, requiring more computing power to release fresh tokens into circulation.

Meanwhile, some upcoming events in the crypto calendar could give traders cause for some sustained New Year cheer. Even if it’s still a year away, the “halving” of bitcoin is a frequent source of excitement for crypto investors.

Some investors believe that the halving, which involves reducing bitcoin rewards to miners by half, will boost the price of bitcoin as it will reduce supply. The next halving is expected between March and May of 2024.

Hester Peirce, a commissioner at the US Securities and Exchange Commission, emphasized that after a disastrous year, market players need to keep in mind what cryptocurrency is actually all about.

Peirce pointed out some lessons to be learned from the challenges the crypto industry had to deal with last year in a keynote at the Digital Assets at Duke conference.

Bitcoin and FOMC

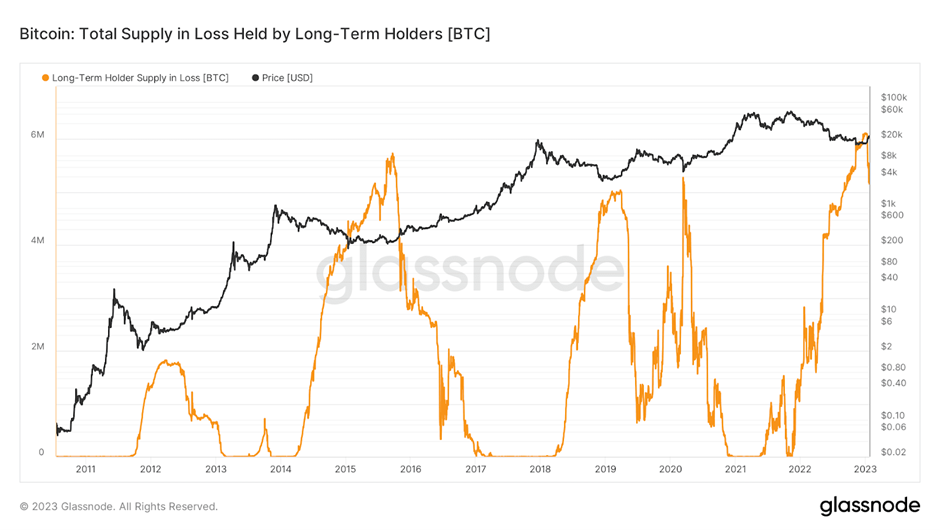

With BTC up more than 40% in January, another point of concern centered on the urge to extract profits. Despite more than a year of losses, analysts at Glassnode noted that long-term investors were generally resolute in their decision to remain in the market.

Is this yet another indication of strength and trust in the crypto space?

The price of Bitcoin alone is insufficient to assess the state of the crypto market.

Data analysis by CryptoSlate believes a tight correlation between Bitcoin and Gold may signal the beginning of a price run-up depending on whether the Fed hiking schedule is fulfilled by March.

The FMOC meeting took place on the 1st February. Even though the markets had anticipated the rate increase they have responded favourably to Jerome Powell’s remarks, even with him hinting that there will be additional increases.

Even if did Jerome Powell did stick to a hawkish script during the post-meeting news conference, the consensus was a temporary price pullback for a short period of time.

The market has recently developed resistance to hawkish Fed chatter, so the anticipated Powell-induced pullback would have been short lived.

Earlier throughout January, several Fed officials issued rate increase warnings. Yet bitcoin managed to climb by 40% this month, with riskier cryptocurrencies like gaming tokens mounting massive rallies.

Is the hope for a new lower low now gone?

A reliable predictor of future moves is the proportion of Bitcoin holders who made a profit. These holders purchased their bitcoin at a price lower than the current market price.

The general consensus is that the BTC holders who have seen their value rise are more likely to sell, which might trigger a market swing. Those whose investments have lost value are more inclined to hold onto their BTC, generating buying pressure.

Bitcoin crossed above several cost-basis thresholds, including realized price and short-term holder-realized when it reached $23,000. Investors who purchased BTC before the COVID-19 outbreak are now profiting from the long-awaited but gradual rebound.

However, those who purchased BTC during the pandemics of 2020, 2021, and 2022 saw their investments sink in value. Investors who bought the dip at the start of January 2023 have already reaped the benefits as Bitcoin’s price shot up all month.

The total supply of losses held by long-term investors reached an all-time high by the end of 2022. And although the amount decreased from 6 million BTC to 5 million BTC since the start of the year, it still indicates that a sizeable chunk of the supply is at a loss.

These data suggest that long-term investors might keep the 5 million Bitcoins in their possession until they meet the realized price, posing a substantial resistance that might prevent Bitcoin from sliding below its 2022 bottom.

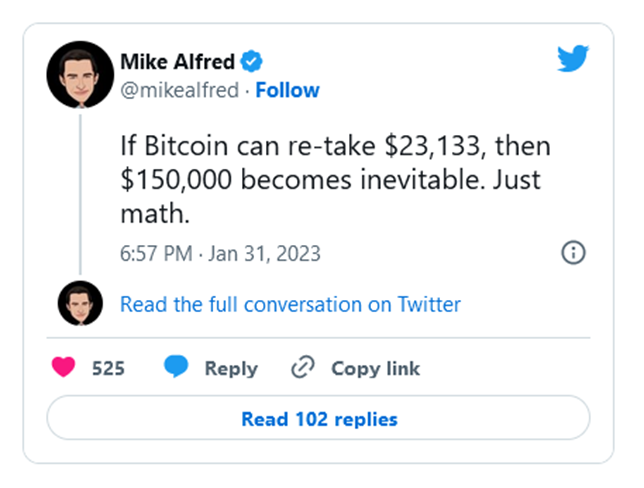

Many influential web3 players are forecasting new highs for Bitcoin. Mike Alfred, a venture capitalist who was also the founding CEO of BrightScope and Digital Assets Data, shared a scenario that, in his opinion, would signal Bitcoin’s further ascent toward the $150,000 milestone.

Institutional vs Retailers

Investors from institutions like banks and hedge funds frequently engage in a game with novice (retail) investors within the markets. The objective is to shift wealth from retail investors to these entities.

It is extremely easy in an unregulated market like crypto where institutions can manipulate prices.

Since the FTX disaster in November, retail investors have aggressively purchased bitcoin, leading to the highest number of addresses owning at least one BTC. On the other hand, big institutional investors have been selling.

The crucial question is when the accumulation phase, which usually concludes a bear cycle in any market, will end for bitcoin. This pattern of repeated testing of two areas—Support and Resistance—by the asset’s price is called Wyckoff accumulation.

Institutional investors will resume buying the asset whenever they determine that the lower bound has proven to be sufficiently resilient or when they believe the price is reasonable.

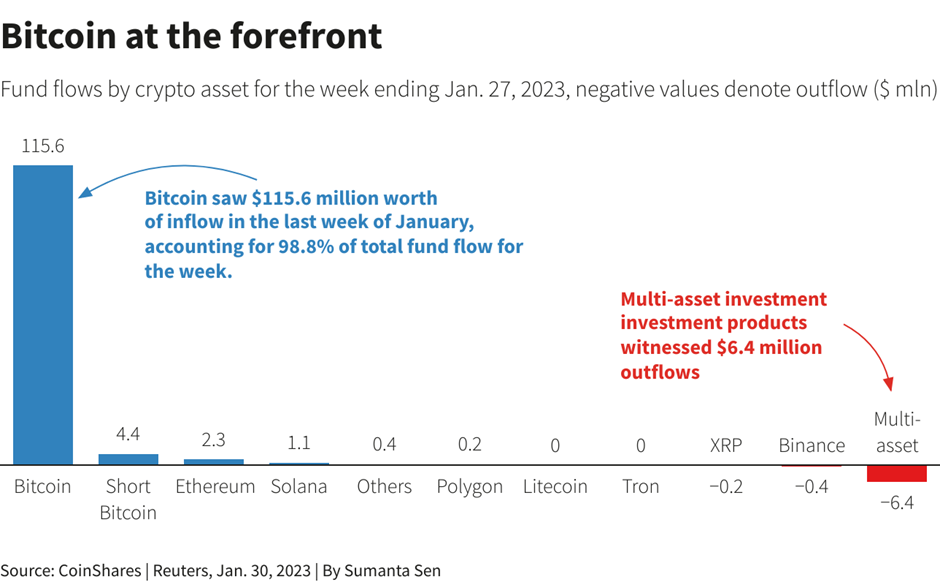

In fact, following a stellar month for bitcoin, investment firms are re-dipping their toes in the crypto waters. The amount invested in digital asset investment products, frequently preferred by institutional investors, jumped by nearly $117 million last week, the highest since July last year.

Furthermore, January’s, bitcoin’s “dominance,” or percentage of the entire crypto market, has been hovering around 41%, levels that have not been seen since last July. It echoed a spike in bitcoin dominance that unfolded in April 2019, when a bitcoin rally signaled the bottom of the cryptocurrency market.

A continuation of this pattern would indicate the end of a bear market.

The realized profit and loss for the entire market were recorded as positive in January 2023 for the first time since April 2022.

However it’s more likely that there will be more hardship. It doesn’t suggest the kind of optimism that usually propels markets upward with a recession on the horizon, unprecedented levels of massive layoffs, and weak retail statistics coming out of the US.

Market Sentiment

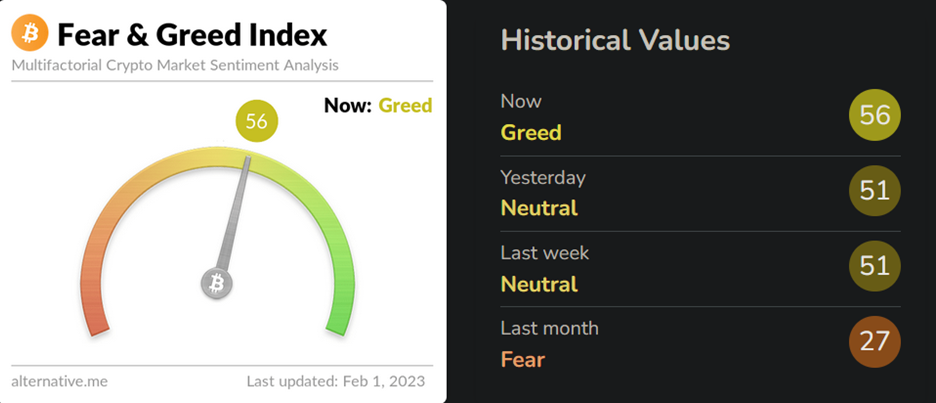

The Bitcoin Fear & Greed Index (FGI) has entered the “Greed” zone for the first time since April 2022.

The index began the year in the “extreme fear” zone, showing that the bearish sentiment dominated the market at the beginning of the year.

But as Bitcoin rose from $15,600 to $17,200 during November and December, the FGI pulled off from extreme fear.

Investors remain concerned about potential negative catalysts like the Digital Currency Group crisis. As a result, there is a high probability that the market will continue to decline, and many experts think the current price action is a sign of a bull trap.

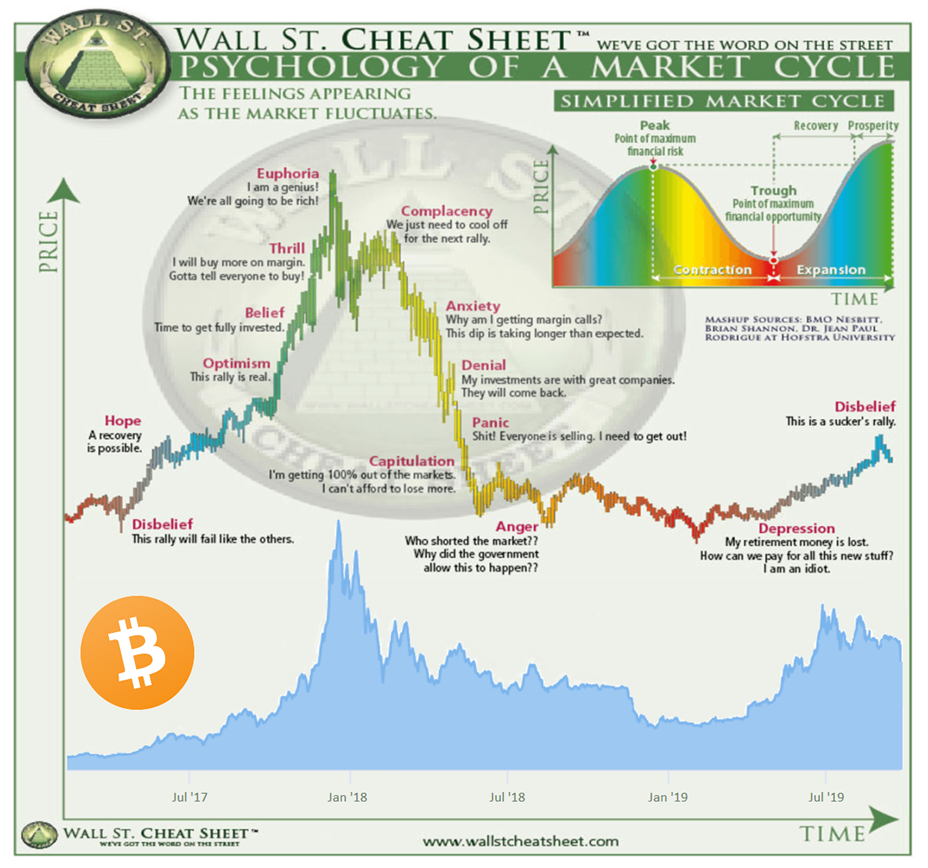

Let’s look at the iconic graph that depicts the typical investor mentality at each stage of a price cycle.

The ultimate stage of a bear market is depicted as “disbelief” in the illustration. The market enters the bull zone again after the “disbelief” phase. So, the question is- are we in the “disbelief” phase yet?

Since there is no crystal ball to foretell the price of bitcoin, such pictures are far from being completely accurate.

Indeed, there is finally some grounds to hope for a quicker-than-expected return to the bull cycle, given the declining inflation rate and the fact that there is just over a year until the next Bitcoin halving.

Remember, in previous cycles, it wasn’t as obvious that “Bitcoin would come back,” whereas now, the world is gradually acknowledging that Bitcoin is here to stay.