The American regulator Securities and Exchange Commission is going on a crusade against cryptocurrency staking services. And one of its first victims is the crypto exchange Kraken, which will have to close its crypto staking service in the US.

The crypto trading platform Kraken has also been fined a hefty 30 million dollars. SEC’s ban is a blow to Kraken and the rest of the crypto sector, especially after the months-long crypto winter financial difficulties. Also, SEC’s ban resulted in the momentary fall of the prices of crypto assets, most especially bitcoin.

But that’s not all.

In this article, we will analyze the SEC ban, the reason for the sanction, the possible consequences on the market, and what the future holds for Kraken and the world of crypto staking.

What is Kraken staking?

Kraken is a US cryptocurrency exchange serving Canada, the European Union, Japan, and the United States since 2011. It’s the third largest cryptocurrency exchange in the world, behind only Binance and Coinbase, according to Coin Market Cap.

Behind this overwhelming success is the Kraken staking. So, what is Kraken staking?

Kraken staking is a feature that allows users to earn rewards by holding specific cryptocurrencies on the exchange.

By staking their assets, users contribute to the security and operation of the blockchain network. In return, they receive some of the network’s transaction fees and inflationary rewards.

This staking feature is among the most straightforward and linear in the entire crypto world and allows us to earn passive income.

Kraken staking is fantastic due to various special features. Some of these include:

Good selection of projects

It has around 15 assets available that you can use for staking, from Ethereum to Polkadot, via Tezos, Kava, Cosmos, and many other networks that are among the most popular with cryptocurrency enthusiasts.

No minimum amount

There is no minimum amount to access Kraken staking service. You can stake very low minimums and access the service immediately and in just one click. It is, therefore, an excellent opportunity for all those who want to understand the functioning of staking without “risking” significant sums.

Returns paid cyclically

The user receives rewards every 3 or 7 days, depending on the network. The user can even put back rewards into automatic staking or withdraw it at no additional cost. Paying off this frequently makes it much easier to reap the benefits of compound interest.

Free

You can unstake and move your assets except for Ethereum. With Kraken staking, you can make your moves as you prefer, even without setting up long-term locking strategies.

The SEC’s decision to ban Kraken staking

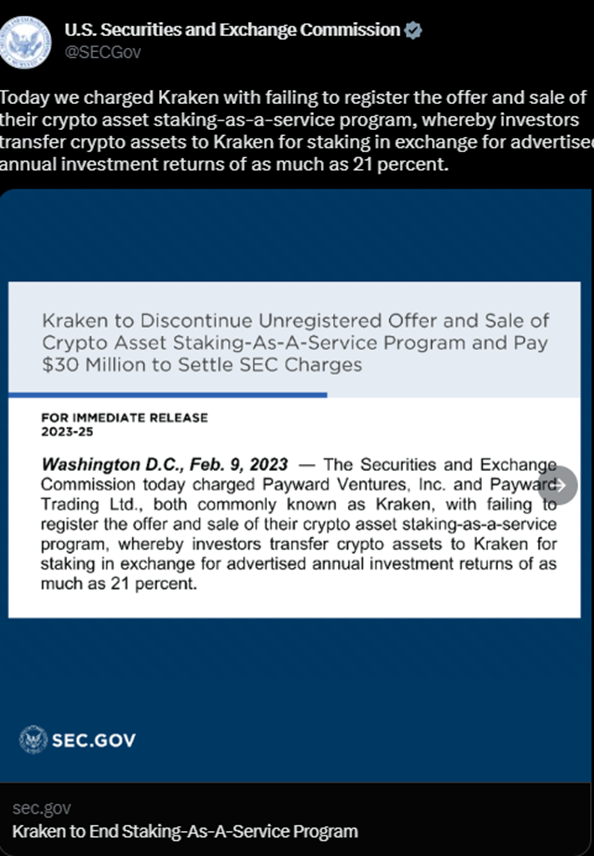

The SEC criticizes Kraken for not registering its crypto-staking service with the regulatory authorities. Because of this, the service was illegal in the eyes of the SEC. On its website and Twitter, the SEC and its chairman, Gary Gensler, indicate that they have acted to protect retail investors by closing this unregistered crypto-staking program.

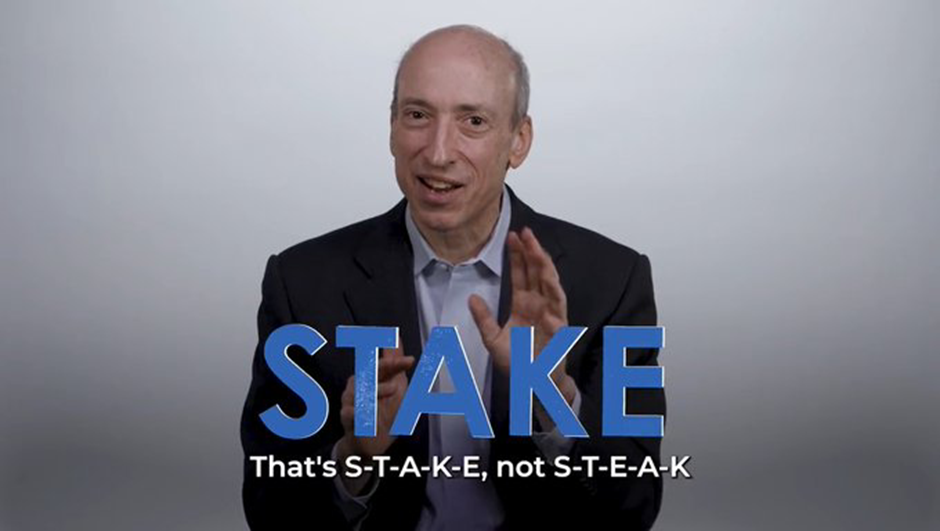

Gary Gensler also published a video on Twitter with questionable humor to explain to the general public why this crypto-staking service had to be shut down by US regulators.

In the video, the chairman of the SEC alludes in particular to the bankruptcy of major crypto players, such as FTX, Celsius Network, BlockFi, Genesis, and Voyager Digital, which offered crypto staking.

The action clarifies that staking-as-a-service providers must register and provide complete, fair, and truthful disclosure and investor protection.

If a platform goes bankrupt, investors end up in bankruptcy court. That is why it is so essential that these companies comply with securities law.

However, the company confirmed that the closure of Kraken’s crypto staking service only affects its US customers, not other foreign countries where it offers its services.

Regardless, the SEC’s action is a repression of the crypto sector. Many in the industry fear an imminent attack on other companies like Coinbase, which also offers crypto staking in the United States.

Nicknamed the “Crypto Mom,” Hester Pierce, who works for the American regulator SEC, strongly condemned the actions of the regulatory agency, which led to the closure of the Kraken crypto staking service.

In an official statement published on the SEC website, Hester Pierce does not mince words and denounces “a paternalistic and lazy regulator” and “hostile to crypto.”

Consequences of the Kraken staking ban

When the ban was announced in February 2023, the first consequence was investors losing their crypto passive income. But it also affected the market. The price of bitcoin, for example, went down to $21,600 from around $23,000.

In the end, the continued repression of the American regulator SEC could push many crypto companies to leave American territory. Companies might try to avoid being prosecuted and paying colossal fines, like the one imposed on Kraken.

It recently happened to the crypto-staking platform Nexo which also suffered from the SEC. The company, therefore, decided to leave the United States after paying a fine of 45 million dollars to end the proceedings initiated by the SEC.

Currently, in a lawsuit with the SEC over its XRP cryptocurrency, Ripple has stated in the past that it is considering leaving the United States. The crypto regulations imposed by the SEC that tirelessly pursue crypto startups might be detrimental to the development of this booming sector.

The worries for crypto companies are far from over, as stablecoin issuer Paxos, which notably issues Binance’s BUSD, is reportedly under investigation by the New York regulator.

SEC is also suing crypto lending platform Genesis and crypto exchange Gemini along the lines of Kraken and Nexo.

Coinbase also has a crypto-staking service

Following this condemnation of Kraken, Coinbase indicated that its crypto staking program is not affected because it differs from Kraken’s.

Coinbase General Counsel Paul Grewal says Kraken was offering a traditional yield product, whereas Coinbase offers a commission-based service.

Staking rewards for Coinbase customers depend on rewards paid out by blockchain protocols in staking and commissions received by Coinbase’s crypto staking service.

Despite Coinbase’s statements, its COIN stock price still fell on the stock exchange.

The future of staking in cryptocurrency

On what the future holds for Kraken and staking in the US, Kraken co-founding CEO Jesse Powell said he hopes for a legal, user-friendly version of custody staking.

The ban on Kraken staking could harm the cryptocurrency industry’s future. It could lead to decreased user confidence in staking as a reliable source of passive income. It also can potentially reduce staking adoption to secure and validate blockchain networks.

Users impacted by a Kraken staking ban could explore alternative staking options on other exchanges, such as Coinbase. Unfortunately, Binance and Bitfinex staking are not allowed in the US.

Additionally, staking enthusiasts could consider self-custody staking by running their validator node or delegating in a staking pool.

Conclusion

Following the announcement of the SEC’s repressive measures taken against Kraken, there are concerns all over the place. Regulation has reigned since the beginning of 2023, after 2022, an unforgettable year. In the long run, other exchanges offering similar services as Kraken could also get sanctioned.

Overall, the ban on Kraken staking is a reminder of the risks associated with centralized staking services. Users should consider diversifying their staking portfolio, exploring alternatives to Kraken, and self-custody options. With proper due diligence and risk management, users can continue to benefit from staking rewards while contributing to the security and growth of the cryptocurrency ecosystem.