Key Takeaways

- Sei Network is a general purpose and fastest Layer 1 blockchain

- Sei is optimized for trading applications and an enhanced user experience

- V2 is on the way, which means interoperability with EVM applications

- The biggest adoption barrier for Sei would be a reluctance to switch from more established platforms and ecosystems

Crypto education and adoption continues to increase yearly, but what is the roadblock to on-chain adoption? The biggest roadblock chains are trying to solve is onboarding and user experience. Currently, completing a task on-chain is fundamentally more difficult than off-chain. Also, the process to onboard someone on-chain is time consuming and full of friction.

The Sei Network is emerging as a significant player within the blockchain space. Sei’s entire thesis is built around improving the user experience to onboard the masses. This open-source layer 1 is specialized for trading, focusing on optimizing its infrastructure to support a wide variety of dApps. Sei is a general purpose ecosystem because everything can be viewed as a trading application.

Sei Network Advantages

1. Trading Applications

Currently, everything in crypto is tied to trading, whether it’s through decentralized exchanges (ex: uniswap, sushiswap) or marketplaces (ex: OpenSea, Magic Eden). Trading activity is a magnet for users, liquidity and developers. Sei’s core focus is on enhancing the user experience and optimizing the network to facilitate high-volume decentralized trading. Sei Labs focuses on the core blockchain infrastructure and the Sei Foundation focuses on incentivizing developers to make high level dApps to attract more network usage.

2. Speedy Sei

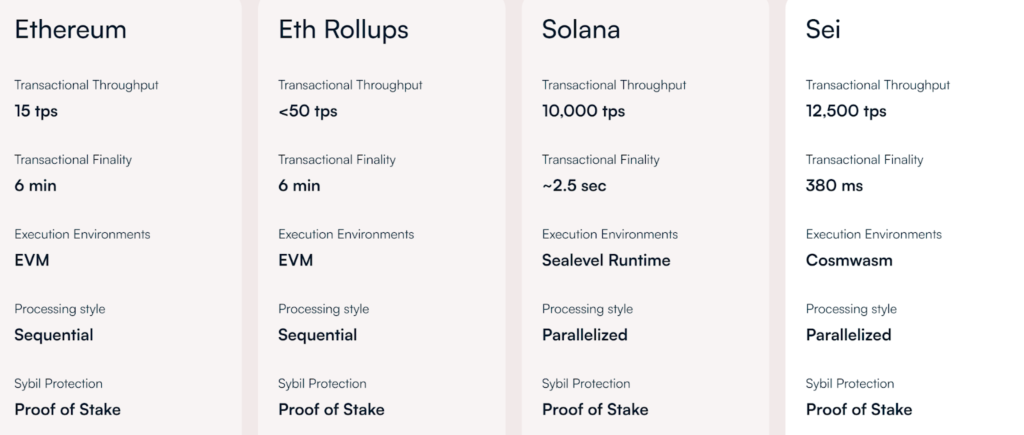

Sei boasts rapid processing capabilities and high data throughout, which are necessary for the performance of trading applications.

Time to finality (TTF) is one of the biggest advantages of Sei. It takes several seconds for transactions to be finalized in most major networks (especially Ethereum). Sei is about 2 times faster than Sui and 1.5 times faster than Aptos. In web2, when you go to do something it’s instant. This helps prevent user dropoff.

Transaction throughput measures the rate at which valid transactions are approved for blockchain entry within a certain period. To enable low gas fees for users, you need a high throughput chain. Solana is one of the leaders, but Sei has surpassed them in both transactions per second (TPS) and TTF.

3. Maximal Extractable Value (MEV) Bot Protection

MEV bots have plagued individuals on blockchains for years by front-running transactions and exploiting blockchain users. The Sei network attempts to minimize this negative MEV through frequent batch auctions (FBA). MEV on liquidations and arbitrage will also be based on FBA. Value is captured by auctioning the block sequencing rights to validators on a per-block basis. The auction profits will be used to passively reward validators and Sei stakeholders.

4. Parallelization

The Sei v2 upgrade introduces a parallelized EVM (Ethereum Virtual Machine), which will be a massive boost to the ecosystem. This upgrade combines the best parts of both Solana and Ethereum. Sei utilizes Rust contracts (like Solana) while EVM networks utilize Solidity contracts. EVM compatibility will help Sei align with users from the Ethereum network and developer crossover.

Ultimately, execution environments in web3 are similar to programming languages in web2; the end user doesn’t care. The same will happen in crypto as greater adoption occurs.

5. Interoperability

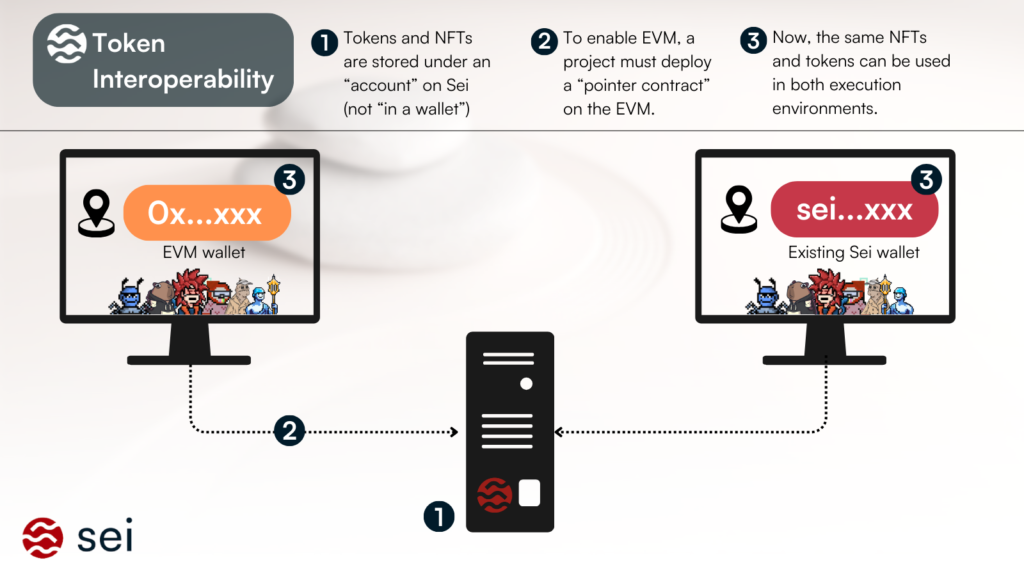

Currently, Sei supports CosmWasm smart contracts and associated “CW” tokens. The Sei v2 upgrade will introduce support for both CosmWasm and EVM execution environments at the same time. Now, you may worry that this will introduce too much complexity into the ecosystem and harm the user experience, but Sei has that covered.

Smart contracts on v2 will be controlled by “pointer” contracts that establish a link between tokens in both EVM and CosmWasm environment. This means you don’t need to wrap your tokens to move between Ethereum and Sei. The pointer contracts allows the token balance to be controlled on both EVM and CosmWasm at the same time. It also means listing an NFT on Pallet (Sei Marketplace) can be possible from an EVM wallet (ex: Metamask).

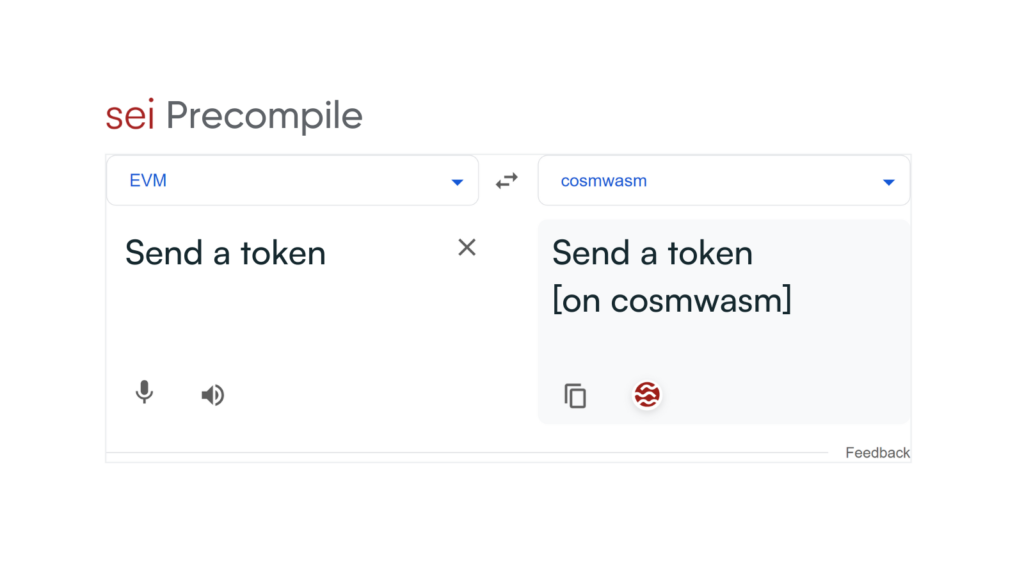

How? Sei Labs has created “precompile” smart contracts to allow native Sei functionality on the EVM side. You can picture it like Google Translate. A list of precompiled functions can be found here.

Sei Decentralized Apps

Sei has 100+ dApps being built within the ecosystem by a variety of teams, many which are gearing up for the release of Sei v2. There are a few mainstay dApps currently within the ecosystem.

1. Astroport

Astroport is a DEX that operates based on the AMM model. Their goal is to establish themselves as a major liquidity center within the Cosmos Ecosystem. You can check out information about their pools, tokenomics, governance and more from their docs.

2. Pallet Exchange

Pallet is currently the premier marketplace for trading NFTs in the Sei ecosystem. The team behind Sei has a gaming background and have shown themselves to be quick innovators. This marketplace reminds me of a young OpenSea. A recent $2.5 million raise gives them the opportunity to remain at the top.

3. Silo

Silo is a liquid staking protocol built on Sei. Liquid staking gives users the two opportunities. One is to participate in proof-of-stake security and earn rewards. The other is a token that can be utilized in trading / deFi as long. In both cases your token is auto-compounding daily. You can also use the traditional 21-day unbonding period or receive funds instantly for a small fee. Learn more in their docs.

These are just a few of the many applications being built on the Sei network. “You can focus on user acquisition and we will focus on building the best infrastructure for you.” This is Jay Jog and Sei Labs’ core promise to teams/developers. A statement like that is very attractive to future developers looking to build on Sei.

How to Purchase and Use $SEI

Sei can be purchased through many popular centralized exchanges (CEXs) like Coinbase and Binance. It can also be bridged through the official Sei bridge or one of my favorites Rocket Exchange.

Before you can bridge $SEI to the Sei ecosystem, you’ll need a wallet. There are a couple of preferred wallets people seem to enjoy. My personal favorite and most popular is Compass, but others have been a fan of Leap as well. With the release of v2 you’ll also be able to use EVM wallets. Sei wallets, such as Compass, are also updating their build to support Sei and EVM wallet addresses from the same interface. This means you’ll be able to see funds deposited into your EVM address via your Sei address.

The Challenges Ahead

Is Sei ready? If you would’ve asked me this 3 months ago, then I would’ve said there’s a lot of work to do. Recently, Sei dApps, digital wallets, marketplaces, etc. have all been iterating quickly in preparation for v2. A possible influx of users will help load test the ecosystem.

The biggest issues to the growth of Sei would be a reluctance to switch from more established platforms and ecosystems. Top tier trading applications need to be created to incentivize more users. This goes back to bringing in developers to create sticky applications, which leads to recurring daily active users (DAUs) and total value locked (TVL).