The Puzzle of OpenSea Private Sale Fees

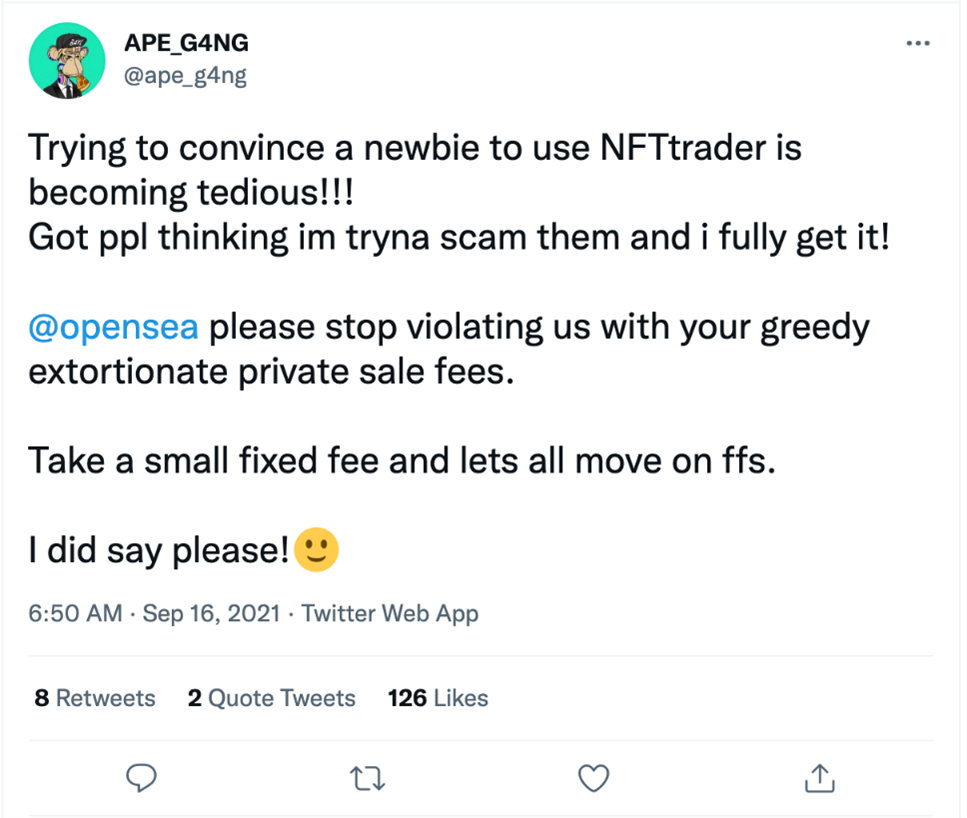

The following @ape_g4ng post from earlier this week really resonated with me as a market designer:

Here’s why: as I teach in my course at HBS (framework notes here and here), a marketplace’s pricing should be a function of the value that the marketplace adds to each transaction.

It’s hard to argue that OpenSea is adding the same amount of value in private sales as it does for public listings. In the case of listings, the platform is hosting the offering, drawing prospective buyer traffic, and sometimes managing an auction/bidding process – whereas in private sales, the platform is really just providing transaction processing support.

That doesn’t mean the platform isn’t adding value to private sales – in both cases, the platform serves a crucial trust role.

By handling transaction processing, and backing those transactions with its brand and customer support team, OpenSea makes people comfortable buying from and selling to people they probably haven’t met IRL. That’s necessary in order for NFTs to have liquidity, and many other platforms haven’t achieved the same level of user confidence. (Could you imagine selling an NFT to someone over Craigslist?)

But even the trust role can be less important for private sales, which by definition happen between parties who already know each other to some degree. In any event, it certainly doesn’t seem appropriate for OpenSea to take the same percentage fee from private sales as from public – as it recently started doing.

Pricing on a sliding scale

And while we’re talking about marketplace pricing, it’s also worth thinking about whether a platform like OpenSea should be charging a fixed percentage in the first place. Once again, it comes down to a question of how much value the platform is adding to transactions.

If the value-add scales linearly with transaction size, then a fixed percentage fee would make sense. And it is true that the trust role is more important for larger transactions than for smaller ones – you’re more worried about counterparty risk when you’re selling a Genesis Kong or Bored Ape.

But nevertheless, the overall transaction support on OpenSea isn’t really linear in price, which suggests a nonlinear pricing scheme could make more sense – potentially a declining percentage for larger transactions, or even a cap on the total take rate. For private sales, in particular, it might make sense to just charge a fixed listing fee.

Inviting competition?

If OpenSea doesn’t align its pricing to value-add in the long run, that could leave it open to competition. For example, the crypto exchange FTX – which recently launched its own NFT marketplace – has signaled that it’s thinking carefully about fee structure design.

While a new entrant in the NFT space wouldn’t have OpenSea’s brand trust and recognition, it could potentially undercut on price so much that users would have a strong incentive to switch. And especially if larger marquee transactions move over to a competitor, that will put immediate pressure on OpenSea’s revenue – and could eventually threaten its network dominance.

Disclosure: Kominers provides market design advice to a number of marketplace businesses and crypto projects, including Novi Financial, Inc., the Diem Association, and Quora.

3 Comments

Major thankies for the blog article.Really looking forward to read more. Awesome.

isatai b9c45beda1 https://coub.com/stories/2622755-david-straker-changing-minds-pdf-hot

brolen b9c45beda1 https://coub.com/stories/2637533-principles-of-real-estate-practice-best