Whilst the likes of crypto and NFTs have plagued authorities when it comes to tax statuses, the crypto mining industry – i.e. the backbone to the world of DeFi – has largely cultivated concerns regarding environmentalism and energy consumption.

With almighty computational computers being the driving force behind such space, resource consumption has always been an issue here, which in turn, has meant that crypto mining has always been on governments’ radars.

Per recent events, the US is seemingly ramping up its efforts to tackle the issue in a domestic sense, whilst in contrast, the landlocked Himalayan Kingdom of Bhutan is seeking international funding to help bolster its efforts in such space.

Crypto Mining in the US: Heavy Taxation Inbound?

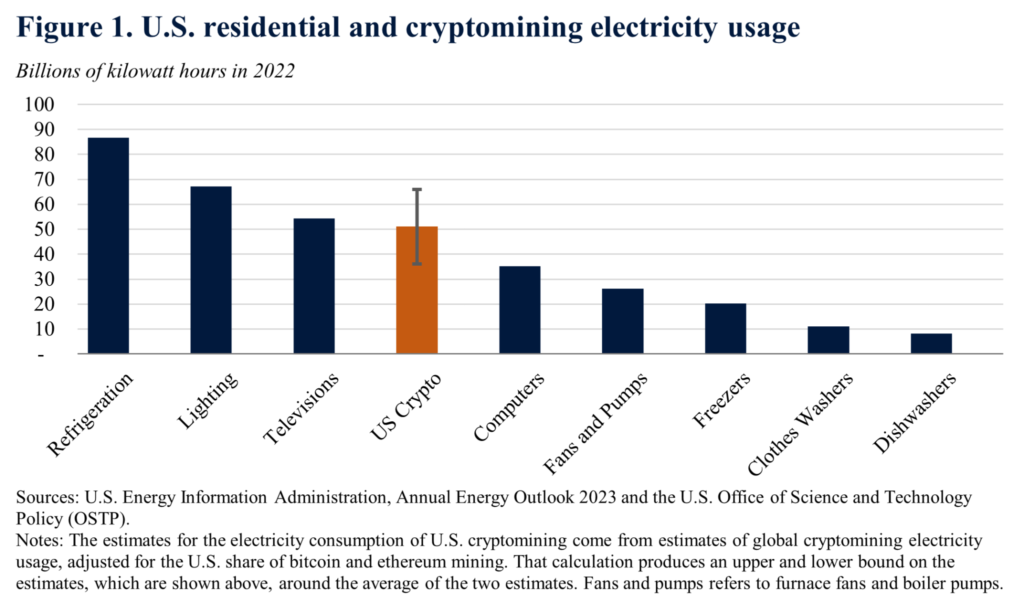

In a quite unfathomable stat, crypto mining in the US was found to consume more energy than every computer device in the entire country in 2022. In total, the recent White House report on the proposed Digital Asset Mining Energy (DAME) tax estimated that 50 billion kWh (kilowatt hour) was used by the industry last year- with such figure being the average of upper and lower bound estimates.

Here, if the lower bound limit was to be used, US crypto mining consumption would still be above that of computers, whilst if the upper limit is used, the industry would’ve used more energy than the entire lighting industry in the country. These calculations were made using both global crypto energy usage and the US’ share of Bitcoin and Ethereum mining up until ‘The Merge’ in September.

Through such figures, only three other ‘industries’ trump US crypto mining’s energy conniption last year, with those being refrigeration, lighting, and TVs. On reflection, this is a rather staggering feat by US crypto fanatics, as of course, these other three industries are observed in nearly every building and industrial complex across the country.

On the flip side, US crypto mining also consumed more energy in 2022 than fans and pumps, freezers, clothes washers, and dishwashers – which again, are all seen within the vast majority of American homes. Of course, the problem here is that the other industries on such graphs all host some – or should I say, a wealth – of benefits for society, as they’re all used to facilitate and enhance many elements of day to day living.

As you’d already know, the same can’t be said for crypto mining, as not only does the vast majority of the American population have absolutely no connection to the industry (nor knowledge of its existence), the benefits that are felt – i.e. monetary rewards – almost always remain insulated within the crypto space.

In pondering how external agents may ever benefit from crypto mining, the most intuitive route to follow is that of simple economics – i.e. that the sole beneficiaries are those involved in the industry’s factors of productions, be it manufacturers, company workers, or plant landlords etc.

What are they going to do about it?

Such a scenario is unsustainable to say the least, which is why the Biden administration has proposed a new set of tax regulations for crypto miners to follow – the DAME tax.

During a recent federal budget proposal, an amount equal to 30% of crypto miner’s energy cost has been proposed to be paid as DAME tax. Such a figure is of course punitive in nature, as the White House’s Council of Economic Advisors said themselves that it was chosen with the ‘harms’ of the crypto mining space in mind.

As economics suggests, the harsh figure – which is one of a rare few ‘industry specific’ penalties’ – is designed to dampen the profits of the industry, which in turn would encourage people to leave, or deter potential newcomers from joining. In conclusion, the intended outcome here is to reduce the number of crypto miners in the US, in order to eventually reduce the industry’s energy consumption.

“Currently, crypto mining firms do not have to pay for the full cost they impose on others, in the form of local environmental pollution, higher energy prices, and the impacts of increased greenhouse gas emissions on the climate.”

Council of Economic Advisors.

Further, the reason why other energy-intensive industries aren’t facing the same scrutiny and punishment is that the Council of Economic Advisers claims that crypto mining ‘does not generate the local and national economic benefits typically associated with businesses using similar amounts of electricity’.

And although we’re all crypto bullish here, it’s hard to argue with such a point, as the other listed industries undoubtedly host genuine household utilities. That is unless you’re looking at the long-term benefits of crypto and decentralised living, and how the relatively ‘short term’ costs of today- which are experienced whilst the space continues to be pioneered – will eventually generate net positives in years or decades to come.

In turn, the tax – which was first hinted at back in March – could raise up to $3.5 billion in revenue over the next 10 years (per the report’s estimates). Here, the biggest contributors to the DAME tax revenue pool will be the likes of Riot Platforms (RIOT), Marathon Digital (MARA), Cipher Mining (CIFR), Greenidge Generation (GREE), BitDeer (BTDR) and CleanSpark (CLSK).

In addition, and looking beyond monetary reparations, the Council of Economic Advisors is also concerned with environmental impacts – be it direct or indirect – of the crypto mining industry and the local communities in which it affects.

Moving forwards, it’s ambiguous as to whether DAME taxes will ever come to fruition, as Republican-controlled House of Representatives – who’ve notoriously been averse to regulating and penalising the crypto sector – are likely to push back on the proposal.

Crypto Mining in Bhutan: A More Bullish Set of Circumstances

Although US crypto mining is now at a crossroads with authorities, the Himalayan Kingdom of Bhutan is on the cusp of receiving funding worth $500 million to help further its already well-established crypto mining space.

In fact, the backer behind such endeavour is aforementioned Bitcoin mining company Bitdeer (BTDR), who, through its fundraising efforts, wants to help enhance crypto mining’s ‘crucial expansion into Asia’.

The Nasdaq-listed miner is working in collaboration with the Bhutan government’s commercial arm ‘Drug Holding & Investments’ to establish the fund, which they are doing through attracting venture capital from international investors this month.

Although the funds are yet to be collected in full, plans are already in place for what they’ll be used for. These include constructing hydropower data centres across the country, which in turn will be able to provide its entire population with the majority of its electrical energy needs. To facilitate this, the deal will reportedly see Bitdeer secure access to 100 MW (megawatts) of power for a bitcoin mining datacenter.

In turn, this will see Bitdeer’s mining capacity increase by around 12%, whilst also spreading the company’s footprint beyond the US and Norway.

“We expect to generate 100 MW out of the 550 MW power supply from Bhutan, where the construction of mining datacenter is expected to begin in the second quarter of 2023 and complete in the third quarter of 2024.”

Bitdeer Representative.

In turn, the Bhutan government hopes that the new influx of infrastructures will ‘accelerate the Kingdom’s digital transformation and economic diversification by exploring emerging sectors’.

With the country’s stunning valleys and ancient glaciers playing home to four main rivers, the country has already been able to harness the powers of hydroelectric technology to power the majority of its 780,000 residents’ electric use, as well as produce around 30% of its gross domestic product (GDP).

With the ‘new sector’ of crypto mining now at its fingertips, its government is now devising plans to leverage its resource reserves – as well as its new $500 million injection – to power its own bitcoin mine. Put simply, the country wishes to use its hydroelectric resources to help power the computational computers which mine the cryptocurrency using increasingly complex mathematical problems.

Plans of such an accord have been underway since 2020, however only this week – i.e. when the Bitdeer fund was announced – has its government disclosed them. In fact, Bitcoin mining in the region began when the price of bitcoin was said to be around $5000 (i.e. April 2019 we can assume), with Druk Holding & Investments also said to have poured millions into now-defunct crypto holdings.

Once – or if – this endeavour is completed, Bhutan will sit alongside Latin America’s El Salvador as the second country to run a state-owned mine.

As of now, it’s unclear as to where the mining stations are situated, as well as whether or not they’ve turned a profit yet. Such mining stations, along with the country’s investor-backed mining expansion and mass purchasing of computer chips have largely been kept from its population, as traditionally, tech isn’t something in which the landlocked country has focused on when it comes to its imports.

With this in mind, Bhutan’s newly found tech focus has come by way of necessity, as related bans and regulations have swept across neighbouring powerhouse countries such as China. Of course, its hydroelectric tech prowess also plays a huge role also.