As we all know, last year most certainly began with a bang for the NFT and crypto space, as the early months of 2022 was following on from the bullish momentum in which the space had generated in 2021. However, come late Springtime we all know what happened – bearish conditions set in, crypto prices began to slump, and in turn, the value of corresponding markets such as NFTs also began to plummet.

Months in – yes months, despite it feeling like years – the crypto market is still nowhere close to its November 2021 peak of $3 trillion (market cap wise that is). This is despite the fact that leading coins such as Bitcoin and Ethereum have made steady (but still uncertain) progress over the last few months.

For context, Bitcoin’s market cap today (May 2023) sits at around $535 billion, which is around 9% less than this time last year (i.e., the time wherein the 2022 crypto winter had just set in). Such a figure is most certainly an improvement on previous month’s readings, as the world’s leading cryptocurrency hit a landmark valuation of $30,000 last month- which in turn, spurred hopes of a market recovery on an aggregated scale. Since surpassing $30k, Bitcoin has steadily maintained a valuation in the high $20,000’s, which although not particularly bullish, is most certainly an improvement of its performance over the last year.

As is the case in crypto, if its grandfather’s (i.e. Bitcoin) value is on the rise, then we could expect the same for altcoins – or should I say, other substantial coins that aren’t necessarily of the ‘meme coin’ variety. These can include the likes of Cardano (ADA), Avalanche (AVAX), Polygon (MATIC), Ripple (XRP), and more.

Of course, the unequivocally leader in this altcoin space is Ethereum (ETH), which in accordance with Bitcoin’s surge to 30k, reached a noteworthy valuation of $2000 last month. Again, similar to Bitcoin, the coin has since slumped to a lesser $1,800-$1,900, however this is still a positive reading compared to the coin’s performance over the past 12 months. In turn, Ethereum’s market cap sits at around $226 billion today, which is a fall from last year’s valuation of $282 billion. In addition, its current value is still over 50% less than its all-time high of almost $4,900 in November 2021.

The rationale behind highlighting these figures is that despite the recent birth and rise of Bitcoin Ordinals, the Ethereum blockchain and cryptocurrency undoubtedly rule over most of the non-fungible space (with Forbes reporting that up until September 2022, 76% of all NFT trade volume had taken place on Ethereum).

Further, given the coin’s mini resurgence at the start of 2023, have we seen the same for the NFT market?

The Q1 2023 DappRadar Report

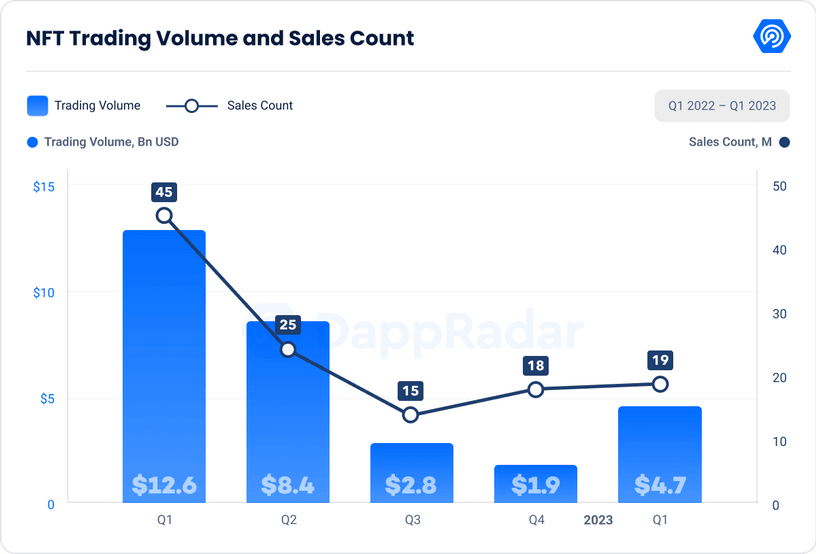

In short, the first three months of the year (i.e. Q1 2023) showed to be rather promising for the NFT space, as it marked the most active trading quarter since Q2 2022 – which as we all know, was the period to precede the beginning of the ongoing bear market.

Trade volume for the whole quarter was up 137% from that of Q4 2022, which in turn, saw $4.7 billion worth of blockchain residing assets change hands throughout the three months. Such a figure comes despite a 16% trading decline in March, which came in response to a multitude of market shaking factors.

Of course, the promising start to the year has largely been down to new competitive forces entering the market, as in and around January and February, airdrop-friendly NFT marketplace BLUR joined proceedings, whilst Bitcoin’s first non-fungible endeavour ‘Ordinals’ also graced the blockchain for the first time. Intuitively, such introductions also explain why March’s NFT trade volume wasn’t as prosperous as February’s (with its sales count of 2.7 assets also being around 4.5% less).

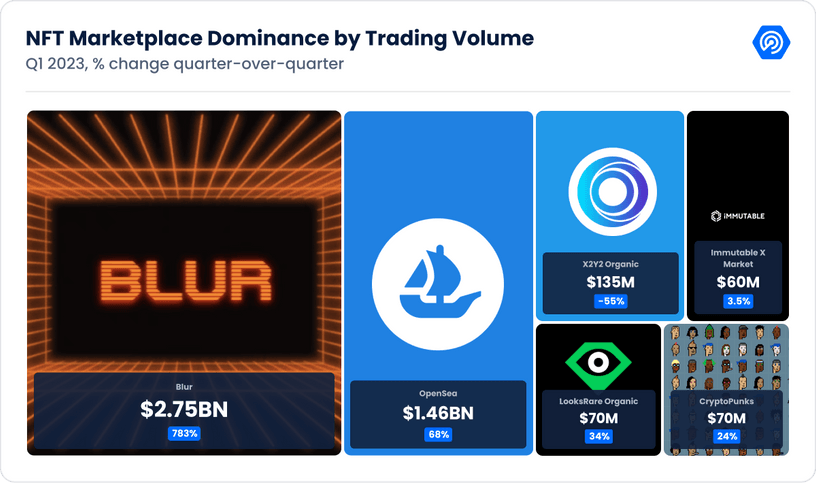

More specifically, Blur’s entrance into the NFT marketplace ‘market’ saw top dog ‘OpenSea’ face legitimate competition for the first time in a while. Marking an incredible 783.89% rise on Q4 2022’s figure, the marketplace facilitated $2.7 billion worth of trades throughout the quarter, which in turn, saw it dominate 57% of the market. In contrast, OpenSea’s $1.4 billion trade volume figure was an increase of 68.41% from that of Q4 2022, however given the successful introduction of Blur, the marketplace’s 31.1% market share was its worst since February 2021.

Overall, the $4.7 billion worth of NFTs sold came through 19.4 million individual sales, which was an 8.56% increase from Q2 2022.

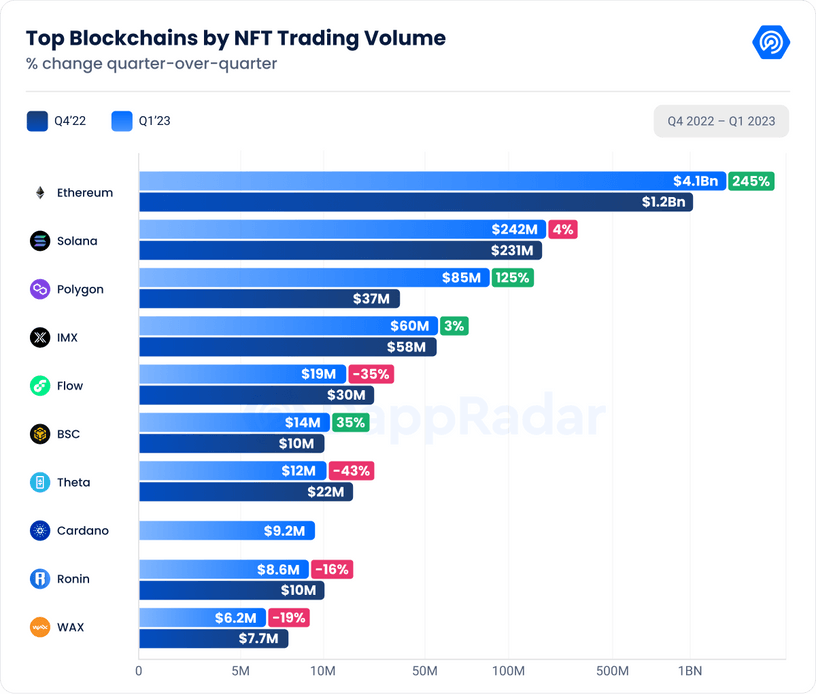

As previously alluded to, Ethereum remained the main player throughout such period, as the Proof-of-Work (PoW) blockchain was responsible for a large majority of the trade activity to take place (ramping up to nearly 90% in March).

In general, the Ethereum blockchain’s quartile trade volume of $4.1 billion was a 245% increase on that of Q4 2022. Of course, the blockchain’s whole host of Blue-Chip assets dominated trading charts, as March saw CryptoPunks become the most trade collection (with a trade volume of $241 million, which is an increase of 1,214% from Q4 2022), whilst Yuga Labs’ vast NFT took up 34.55% of the entire industry’s trade volume.

As expected, fellow non-fungible titans Solana and Polygon claimed second and third place in the trade activity table. Here, Solana facilitated $242 million worth of NFT sales (up 4.55% from Q4 2022), whilst $85 million worth of NFTs were traded on Polygon. For the Ethereum Layer-2 protocol, this was most certainly a grand feat, as such a figure is a 125% increase from that of Q4 2022 (which also makes it its best three month period since the height of the bull market in Q4 2021).

Other notable mentions of the blockchain accord are Immutable and Flow, who together make up the top 5 most active blockchains.

Final Thoughts

So, whilst we remain in the midst of Q2 2023, it appears that the NFT industry has somewhat made advancements from the treacherous conditions of last year. That being said, given that we are literally living in this potential new ‘recovery’ phase, it’s still impossible to say whether the industry is on the up, or whether it’s simply found its new equilibrium (i.e. a new state that sits somewhere in between the bull conditions of 2021 and the bear conditions of 2022).

And although as previous explored here on dGen when discussing the importance of real utility in NFTs, assets of the Blue-Chip variety can still give us a good indication as to where the industry’s health currently sits at (in a similar dynamic to that of Bitcoin and the rest of the crypto ecosystem).

After using this rationale, it doesn’t actual read very well for non-fungible ongoings, as the likes of Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), Moonbirds, and Doodles have all seen major declines in their floor prices since the start of the year. Whilst for many, these assets are, and always have been unattainable- therefore meaning that their prices don’t actually matter- the demand for such illustrious assets still serves as a succinct indicator for how bullish the market is (and has been for the week or months prior).

In addition, there are also dozens and dozens of other NFT projects – albeit of the utility-less, PFP accord – that have also sunk to zero in wake of their seemingly promising launches. Again, this doesn’t bode well for the NFT industry, as in the height of the crypto bull run of 2021, it was harder to find a new project that wasn’t popping off.

Further, it seems that for many, the countless array of PFP projects – many of which lack any invention or ‘wow’ factor – have finally run their course, as with the lack of funds and excitement floating about in the ecosystem, it’s hard for projects to achieve what they set out in their roadmaps. Such circumstance has most famously come to surface through Doodles, which earlier in the year denounced itself as an ‘NFT project’.

In addition, it appears that many community members are simply bored of the many projects that offer nothing but monetary-based excitement through the speculation surrounding their floor prices.

On final inspection, it seems like the industry is at somewhat of a standstill, as whilst the stats and figures appear to be relatively positive, the intangible vibe of the NFT ecosystem still emits feelings of bearishness, boredom, and anticipation for the next bull run to begin (if ever). With this in mind, perhaps the previous possibility is in fact our reality now… i.e. that we are simply living in the NFT space’s new equilibrium.

Alternatively, we could opt to view NFT trade volume figures as somewhat moot points of discussion, as for many, the powers of NFTs doesn’t come through their floor price propensities, but instead, the actual value they present to holders (or even society as a whole). If we were then to adopt this philosophy, perhaps an exploration into NFT use cases and adoption rates across non Web3-native domains would be a more productive use of time.